You may want to know what is micro business. It is considered to be a business that runs on a very small scale. This classification means there is very little staff, business activities and receipts. There does exist a minor difference between micro and small businesses, something that you need to be aware of. You need to know a few things if the plan is to start a micro business.

What is a small business vs. a micro business?

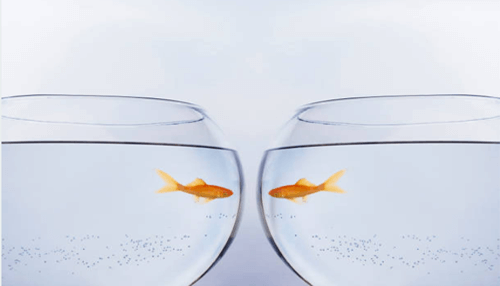

Industry experts term all micro-businesses to be small businesses. However, the difference noticed here is that a micro-business is a small business subset. It is also a community based on employee numbers present within the company. What is a small business? Even if you have employed dozens of staff, then your company is regarded technically as a small business.

On the other hand, it is stated to be a micro business if the number of staff is less than six. You tend to have a micro business if you are self-employed, a sole trader or work alone. Other guidelines are present that define if your business is small or micro. It is a business that needs a start-up capital of just $50,000 or even less. Moreover, if you do not require traditional capital loans, then it is also referred to as a micro business.

What are the challenges of a Micro-business?

There are additional challenges faced by the micro business, something that other businesses do not face. Since you lack domain exposure, you will find it tough to attract and hire talented employees. It is for this reason that micro businesses fail to have a large customer base like that of large companies. Small businesses also find it tough to get loan sanctions from banks and other traditional financial institutions. Such businesses are likely to face hardship trying to develop credit lines with vendors since the chances of defaults are high.

Payroll

About payroll, micro-businesses are found to enjoy unique positions. Since there are few employees in your business, you need to pay less and perform only a few payroll functions. There is also no need for a large-scale reporting or payroll system. You need to engage in a flexible system without having to follow plenty of setup procedures. With the growth of your business, it becomes important to develop a large infrastructure to accommodate the growing needs. But for minimal requirements, there is no need to go for large-scale implementation.

Micro business taxation

You need to pay taxes regularly to the concerned authorities on your micro business earnings. These are almost treated similarly to other small businesses. In the case of business incorporation, prevailing corporate tax rates apply to it. In case, you run a sole proprietorship business, then you will be taxed at the personal tax rate. This particular structure is followed by most micro-businesses since less effort is required to register as well as file paperwork. However, the type of structure selected for any small business or micro business does affect tax evaluation.

Cost cutting & revenue optimization

When compared to a large business, a micro business is likely to have varying operating goals. Fewer expenses are to be borne, thereby increasing your revenue. Your business expenditure is likely to be already low when others are trying to reduce expenses.

Therefore, the major difference noticed between small businesses and micro-businesses is how the latter enhances its bottom line. Large companies have the resources to trim operations. On the other hand, micro-businesses need to develop them. What is a micro business? Such s business is unique and faces certain challenges. This in turn compels it to operate in different ways when compared to other companies.