The concept of Bitcoin halving can be understood from when Satoshi Nakamoto brought the white paper of the first-ever digital currency, Fear Bitcoin. This is much like any other big event that occurs in any field after four years. Just like the Olympics or the World Cup takes place every four days, so is with bitcoin halving.

What Is Bitcoin Halving:

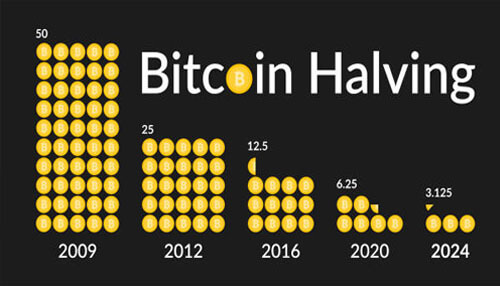

When Bitcoin was first introduced, one thing that was made clear was the bar that was made on the production of Bitcoin. It is very much known to everyone that Bitcoin’s ultimate limit of generation is capped at 21 million. The production somehow is dependent upon the miners, who are entrusted with adding blocks to the chain with a new transaction that is verified by them. For this, the miners get a reward. Earlier when the bitcoin was exclusive, the miners used to get 50 bitcoins as a reward. Back then its value was in cents, but at present, the value of one bitcoin is surpassing many dollars. so buy Bitcoin Canada, it gives a live currency conversion rate

The initial reward of 50 BTC was decided to be for the first 2 lakh bitcoins. This reward was subjected to halving and the price of the reward decreased and the value of bitcoin was seen increasing with time. This is a continuous process that takes place every four years by decreasing the price given as a reward to the miner. After the first halving that took place in 2012, the reward value was cut down to 50 percent, which means 25 BTC for every new block.

What Is The Significance Of Bitcoin Halving:

Halving has been seen as the most crucial aspect of the cryptocurrency area. After the first two bitcoin halves that took place in 2012 and 2016, there was a substantial price hike that was seen in the bitcoin value. Its value increase has not been an overnight concept, rather the 50 percent slash in the reward price, gave a new dimension to the value of this cryptocurrency. However, the hike has not been the same throughout time and has been subjected to many variations.

Later when the second bitcoin halving took place in the year 2016, the value of bitcoin ascended to a new level making it an all-time higher in that year.

Why Halving Ascends The Value Of Bitcoin:

Since it’s been more than a decade now that cryptocurrencies are existing, people seem keen to know, that why bitcoin prices are going high after halving takes place. To answer this I will be giving a brief detail about this.

As per the halving trends, it has been seen that after every halving there has been a rise which was seen in the value of bitcoin. In 2012 when the inaugural halving took place, the bitcoin ascended to a value of 8000 percent. After that, the Bitcoin rewards were also slashed to 50 percent. After that, during the second halving, bitcoin had already gained a lot of momentum and there had been a next-level frenzy amongst people about bitcoin. Initial coin offering on the other hand also added to the value hike, since ICO was also quite prevalent at that time.

Conclusion

The article, as is clear from the title talks about one of the most important concepts in bitcoin life which is halving. Due to the constant price hike in the bitcoin value, many had this thought that why its prices are going higher. Hence to answer all those questions, I have given a brief detail. I hope you will understand this concept with the help of this snippet of information.