Online criminals might try new and unique tricks to scam you out of money, so you should be on the lookout for anything suspicious. That being said, there are two types of online scams which are prevalent in 2021 and are likely to stick around for many years.

These are:

- Phishing scams

- Advance fee scams

If you don’t know what these online scams are, stick around and stay protected by knowing more.

Phishing Scams Explained

Phishing scams are when a criminal creates something that makes them look like a legitimate worker for a company, such as a fake email address or even a fake website imitating a legitimate one. They will then lure you to the web page by sending you a link through email or text message. Sometimes the scammers are talented, making it difficult to tell the real and fake websites apart.

The scammer will then get you to enter sensitive information into their forged website, meaning you are unknowingly handing over details like bank account information. Your information is then used to commit fraud, take out loans or pay for big-ticket items. It is reported that the FBI states that phishing emails were the most common cybercrime in 2020.

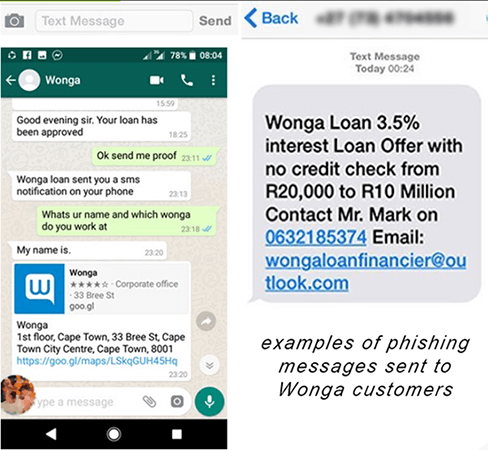

If you want to see examples of phishing scams in the finance industry courtesy of loans company Wonga, then check out the images below. These examples showcase ‘in the field’ examples of what fraudsters are sending. The interesting thing to note here is many of the customers who are targeted have no previous relationship with the Wonga brand and are now suddenly contacted with offers.

This is a classic example of fraudsters ‘playing the odds’ by canvassing a huge number of potential victims with a well-known regional brand. Wonga are on the record defending their own security i.e. no data leaks have come from their secure servers, but as the brand is so well known their ‘image’ makes for a lucrative mask to use when contacting customers who have had their contact information leaked from another source.

The odds are quite good that there is some marginal overlap between people who have had their data leaked from another source, who also happen to be Wonga customers. This is the ‘sweet spot’ scammers are aiming for.

Advance Fee Scams Explained

An advance fee scam is when you are offered something appealing, but you must pay something upfront to get it. Once you make the payment the scammer disappears. There are variations of how this would work, such as:

- Claiming an inheritance but paying a fee for the person to track you down

- Securing a loan with favourable repayment terms but having to pay an application fee

- Winning a competition but needing to pay a small fee to access the prize

The Best Ways to Stay Protected Online

There are many ways to avoid becoming a scammer’s next victim. Getting a second opinion from tech-savvy friends and family is always a good idea. And one of the best is to simply not engage with anyone who contacts you about a loan you didn’t ask for, a competition you didn’t enter, or an inheritance from someone you don’t know.

Additionally, never click a link that is sent to you. Always go back to Google and look for the legitimate website and go from there. If you’re unsure, look up the company phone number and call them directly. Remember, if it seems too good to be true then it almost certainly isn’t true.