You may be eager to know what the 5 types of investments. According to industry experts, there are four major investment types, namely, bonds, stocks, index funds & mutual funds. Bonds & stocks are excellent choices for long-term financial growth. You just have to weigh which is more riskier, bonds vs stocks, when you invest. You do have plenty of options to choose from. So you should undertake proper research and weigh each option carefully to make the correct decision.

The list of investments

1. Investing in Wine

2. Bonds:

In this type of investment, you provide loans to the government or a company by investing in a bond. This way, you lend some money to the bond issuer against interest. When compared to stocks, they are among the much safer investment opportunities you can avail, but with low returns. Like in any other loan, the primary risk here is that issuer might default.

However, government bonds are much safer as it is backed by ‘credit & full faith’, thus eliminating risks. The next safe financial investment option available is city & state government bonds & then corporate bonds. Although it comes with less interest, you can get back your principal amount. Bonds are stated to be fixed-income investment opportunities. You can avail of regular income payments, where interest is received in regular investments. This can be 1 or 2 times a year, with the total principal being paid on the bond’s maturity date.

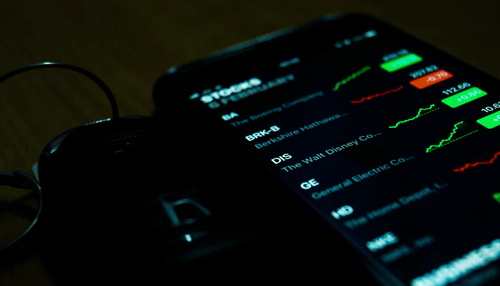

3. Stocks:

If you want to know what are the 4 types of investments that can make you rich, stocks top the chart. Here, you make a financial investment in a particular company. You buy a share, which means a small part of the company’s assets & earnings. To raise cash to expand the business, companies sell off stock shares. You can buy & sell them to others and make high returns.

However, it also comes with some risks. Among the list of investments given here, it is stated to be the riskiest investment type. You need to have a proper & in-depth of the share market. This is because companies may lose value or even wind up their business. As the stock value of that company goes up, you sell their shares that you hold to make profits on your investment. Few stocks also offer dividends considered to be regular distributions from the company’s earnings.

4. Index Funds:

When searching for what are the 4 types of investments, you are sure to come across this investment type. This is a mutual fund type that tracks passively an index instead of paying the manager to identify & select investments. S&P-500 index fund, for instance, helps mirror the S&P 500 performance. This is achieved by holding the companies’ stock within that index. Such financial investment costs much less as active managers are not present on the payroll.

Moreover, risks associated with such a list of investments depend upon investments made within the fund. With index funds, you can earn interest or dividends, distributed among investors. As benchmark indexes, its value goes up, thus increasing fund value. You can sell your held share for a good profit. Such investment opportunities also to charge expense ratios but are much lower when compared to mutual fund fees.

5. Mutual funds:

This is the final of the list of investments mentioned here. This is the perfect choice if you seek other investment opportunities apart from identifying 7 selecting individual stocks & bonds. You can purchase a financial investment in large numbers with just a single transaction. Such funds are said to pool money from a large number of investors. A professional manager is employed to invest this accumulated money in bonds, stocks & other assets.

You need to know what are the 4 types of investments & get to know the pros & cons of each. This way, you can minimize your risks & optimize profits.