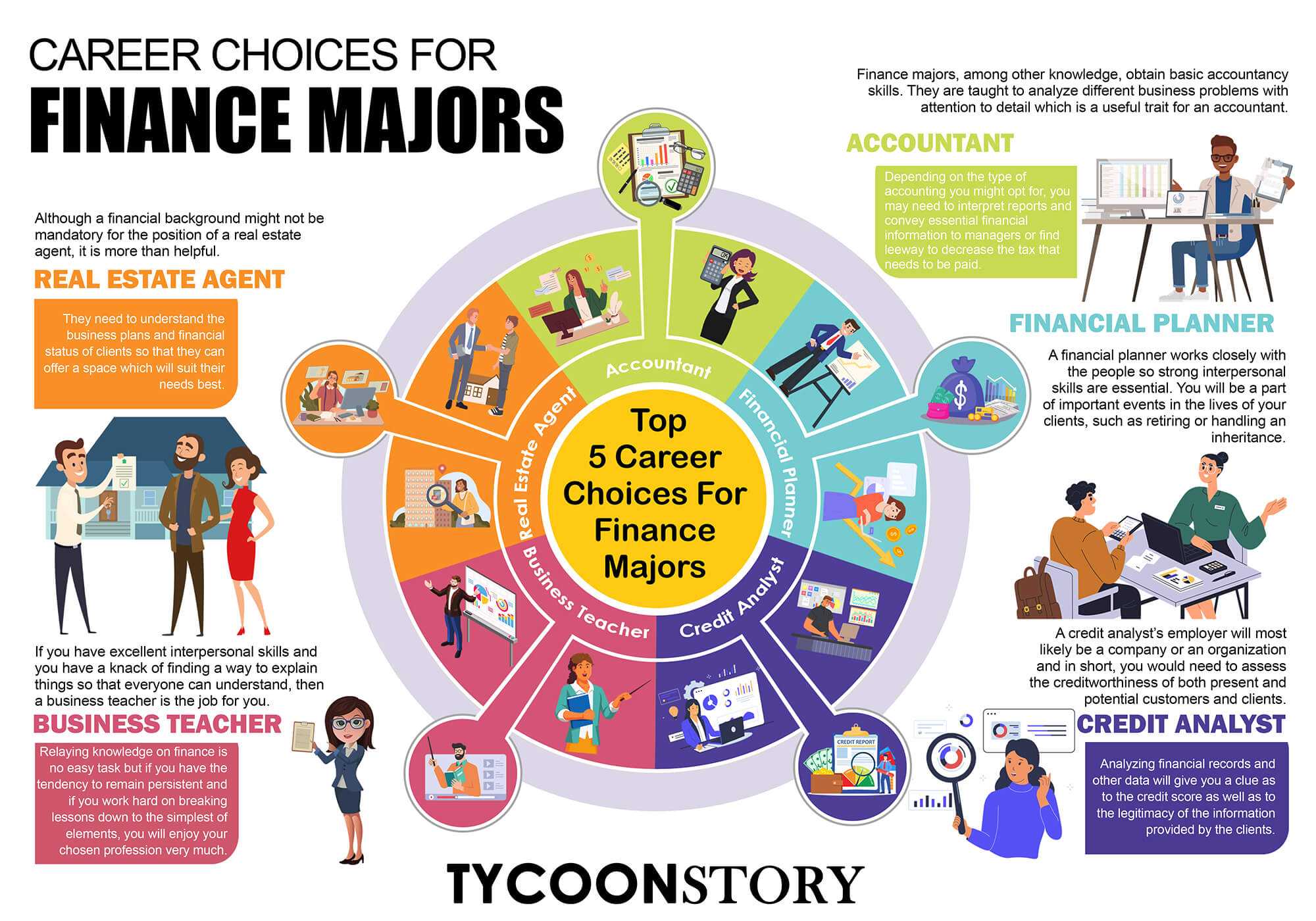

You are a finance major with no clue where to start your professional career? The good news is that, even though you have little or no practical experience, you are equipped with broad theoretical knowledge. This knowledge, together with the analytical skills you obtained through the education system, gives you an opportunity to choose many careers in the world of finance majors. Once you choose one, you can then perfect your skillset and specialize in that niche. To help you make a decision, here is a quick overview of the 5 most desirable career options.

1. Accountant

Finance majors, among other knowledge, obtain basic accountancy skills. They are taught to analyze different business problems with attention to detail which is a useful trait for an accountant. Depending on the type of account you might opt for, you may need to interpret reports and convey essential financial information to managers or find leeway to decrease the tax that needs to be paid. One of your tasks could be related to the payrolls, as well as income and expenditure audit, so the more meticulous you are, the better. Also, the position of an accountant is usually a nine-to-five job in the office, unless specified differently by the employer.

2. Financial Planner

A financial planner works closely with people so strong interpersonal skills are essential. You will be a part of important events in the lives of your clients, such as retiring or handling an inheritance. If your clients wish to start a small business and are in need of an urgent financial solution, you will be looking at the situation from the financial perspective, as well as offer advice on favorable fast short-term business loans whose application process is quicker and the repaying plan shorter.

This profession isn’t for the hesitant; it’s for those comfortable making financial decisions for themselves and others.

3. Credit Analyst

The credit analyst assesses both present and potential clients, analyzing financial data to determine creditworthiness and information legitimacy.

You would also be assessing and setting credit limits, maintaining related customer files, as well as monitoring risk trends. Your financial expertise is crucial in predicting sales trends and communicating skills effectively with clients as a credit analyst.

4. Business Teacher

If you excel in communication and simplifying complex concepts, being a business teacher suits you. Difficult but rewarding.

Your presentation skills should go beyond satisfactory. Use personal experience or guest speakers for practical advice in enhancing student understanding. It’s better to choose financial advisors for every budget and financial situation.

5. Commercial Real Estate Agent

Although a financial background might not be mandatory for the position of a real estate agent, it is more than helpful. They need to understand the business plans and finance majors of clients so that they can offer a space which will suit their needs best. Among other things, it is important to assess just how much the business will expand so that you have some idea about the size of the space they would need.

One way to accommodate growth is by providing empty office rooms next to each other, allowing for easy expansion.

Acquiring such broad knowledge gives you an amazing choice between many career options. Your unique blend of interests, traits, skills, and values will guide your decision and lead to success.