Do you need support handling your personal and business finances? Sometimes, you need to think of solutions that go beyond traditional journals. This is when the town’s best budgeting apps become useful. There are a dozen budgeting applications in the industry. Most of these apps are fighting hard to create an identity for themselves.

A common feature in all these applications would be the ability to create “budgets”. But, there are unique features to identify one from the rest. For instance, some are proficient in budgeting, while others are great in Bill-tracking. Likewise, some apps tend to shoot warnings and notifications when you overspend.

With this being said, here are a few of the industry’s best budgeting apps for you.

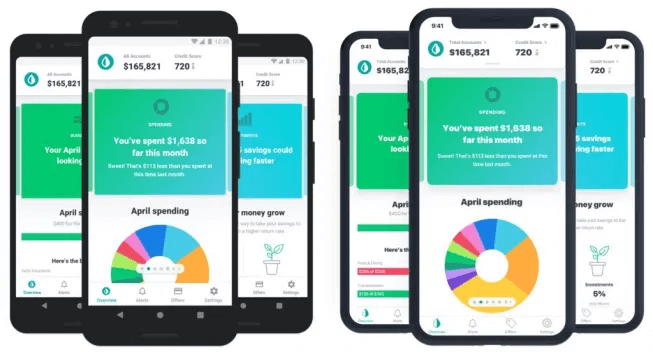

#1 Mint

Mint is one of the market’s oldest and traditional budgeting applications. It belongs to Intuit. This is the same company that designs and develops “Quickbooks”. Mint is designed with many features that can help you handle money like a professional. This includes the ability of cards, brokerages, bank accounts, and financial institutions.

Mint has a special feature that automatically categorizes all financial transactions liked to your bank account, credit card and debit cards. Of course, you can tweak these categories based on your requirements.

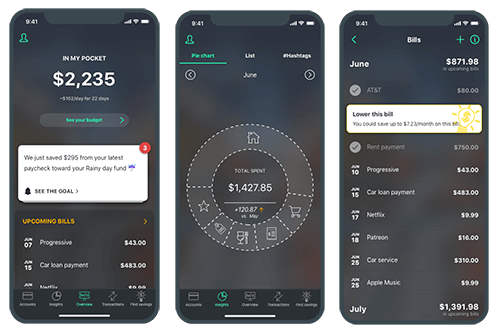

#2 PocketGuard

It is quite evident that “PocketGuard” helps in controlling the amount you spend. When compared to budgeting, this application focuses on tracking how much you spend every month. Setting up, and connecting your account to PocketGuard is very simple. The application can be configured to track everyday expenditures. In fact, all deposits made into your account over a period of time can be monitored.

Key selling feature: Apart from budgeting, and tracking how much you spend – this application will help you reduce your monthly expenditure.

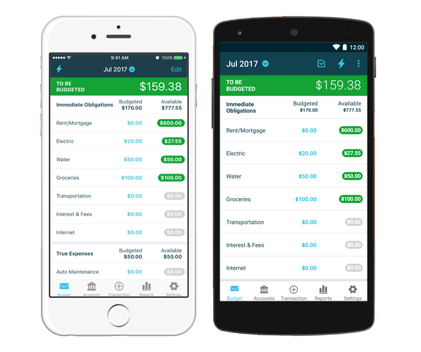

#3 YNAB

“You Need A Budget” is the name of this budgeting application. Unlike other apps for budgeting, YNAB follows a unique strategy. You will be able to put together a budget based on your monthly income. To be more precise, every dollar makes an impact on your budget.

YNAB is a wonderful choice for couples and individuals who are new to budgeting. The application comes in two different versions: desktop and mobile. The app syncs with bank accounts automatically. Also, you can use the application to track expenditures. In the long run, the app will motivate you to reach “stable” money goals. This is quite an important feature that separates YNAB from other budgeting apps.

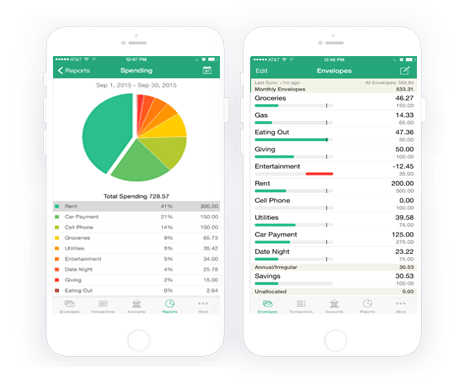

#4 GoodBudget

GoodBudget is much different from the other budgeting applications described in this post. This is an envelope based system. A small portion of your monthly income has to be broken into categories. You can access the same account from multiple devices too. The app doesn’t have to be linked to your bank account. Instead, you have the freedom to enter data. Every time you receive money, you can categorize it. The spending categories can be assigned a fixed budget for each month too. Once the budget is reached, you will no longer have money in the given category. This way, the app stops people from overspending on a specific need or luxury.

#5 Simple

Simple is much more than a conventional budgeting application. Instead, it can be treated as an online banking application.

Most of the time, banking applications are not loaded with impressive features. This is when Simple becomes useful. You can use Simple to incorporate a range of budgeting features into your bank account. When budgeting is incorporated with your life account – things become more real and easy. In fact, you will be able to see and make decisions based on the “actual” amount of money in your account.