A majority of people today prefer online money transfers when they want to make payments for online shopping. Moreover, online services offered by banks allow people to transfer money to others as soon as possible. However, they may face threats from fraudsters after using online services. Therefore, it is wise to ensure high protection while making online finance

ial transactions that will help avoid losses. One should know more about the risks involved in online transactions before processing them.

Tips for ensuring safe online financial transactions

1. Installing genuine anti-virus software

Preventing malware, phishing, Trojans, and other issues on a computer or laptop will help to eliminate identify thefts significantly. Having genuine anti-virus software offers solutions for the problems enabling users to get peace of mind. Anyone who wants to install the same on their devices should know the options in detail. Anti-virus software provides ways to detect and remove spyware to minimize the stealing of sensitive information.

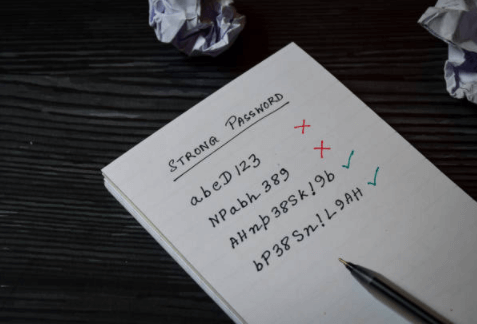

2. Creating strong passwords

It is wise to create strong passwords that contain symbols and symbols followed by lowercase and uppercase letters. However, one shouldn’t use the same user name and password for all online accounts. Users should change their passwords once a month or 3 months that will help get more security from fraud.

3. Checking the latest updates of smartphone’s operating systems

Those who use smartphones for online banking should ensure that their operating systems are free from any attacks. They should check that whether the operating system has the latest security patches with certain tools. This will help prevent hacking and other potential issues to a large extent.

4. Not sharing information with others

People who often use online money transfers shouldn’t share their information with unknown persons. They should avoid providing the PIN, account number, and other details to cheaters when they call on a phone. Besides that, one should avoid answering suspicious emails while asking the bank details.

5. Not saving passwords

Internet users should avoid saving passwords while making transactions online on a computer or other device. This will lead to identity theft, which will result in loss of money. Hence, one should log out of a banking site and other merchant sites to prevent risks in advance.

6. Ensuring secured shopping

While shopping online, people should ensure that the e-commerce websites they choose offer thirty-party payment services. Most sites allow customers to make payments through PayPal and other platforms. By doing this, customers will experience more security which ultimately provides ways to prevent potential threats.

7. Not using public Wi-Fi

One shouldn’t use public Wi-Fi in a location because it leads to hacking that can result in thefts. On the other hand, anyone who is using public Wi-Fi regularly should consider installing VPN software. Having secured VPN software makes it feasible to prevent hackers from intercepting while making online transactions.

8. Tracking the transactions

Everyone should track their online transactions properly which will help find any discrepancies with ease. Keeping records of transactions enables a person to cross-check the details with a bank statement or credit card statement. Apart from that, one can contact the card-issuing bank to report the malpractices involved in the transactions.

9. Choosing mobile apps wisely

Although mobile apps allow people to make contactless payments, not all of them are the same. People who are making frequent online financial transactions should read reviews before installing them. It is wise to use the official apps recommended by the banks that will help avoid risks considerably. Also, they show ways to transfer money in simple steps with high security to eliminate complications in transactions.