Trading platforms have made investing in financial markets extremely accessible. However, the extensive choice can make selecting the right one overwhelming for beginners. The ideal trading platform must be easy to use and provide access to essential trading tools, real-time market data, competitive pricing, and robust security.

As a novice, one should prioritise an intuitive interface, educational resources, and responsive customer support to help build the desired capabilities. It can also be better to assess one’s specific needs regarding markets, asset classes, and preferred devices.

Evaluating factors like usability, mobility, transparency, risk management tools and overall costs can help determine the best fit to kickstart the trading journey efficiently. This blog post explores how the right platform can significantly impact one’s growth as an investor.

Key Factors to Consider When Choosing a Trading Platform

Key factors one should consider when choosing a trading platform include the following:

- User-Friendly Interface: Opt for platforms with intuitive navigation, customisable layouts and one-click trading for ease of use. Simplicity is key when starting.

- Educational Resources: It can be better to select a platform that offers stock market courses, webinars, guides, and demo accounts to build one’s skills without unnecessary risks.

- Cost and Fees: Compare commissions and charges to avoid hidden costs. One should consider a trading platform with reasonable, transparent pricing models.

- Security and Regulation: Ensure that the platform is regulated by reputed financial authorities and features robust security measures like encryption, 2-factor authentication, and fund insurance.

- Asset Availability: Assess asset class availability, like stocks and forex, to align with your interests. It can be wise to start trading popular, beginner-friendly securities.

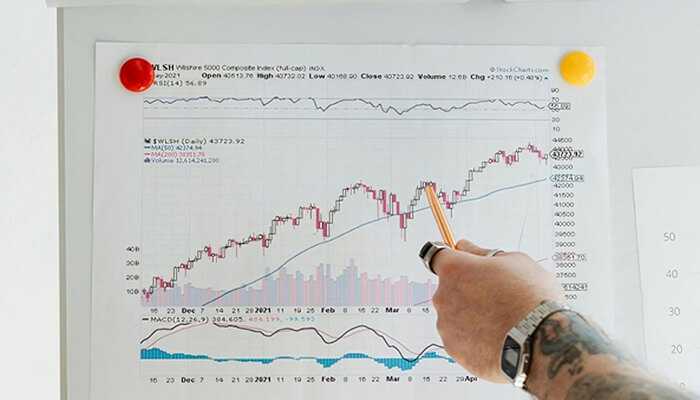

- Research and Analysis Tools: Access to real-time data, charts, and easy-to-understand analytical tools is key to making informed decisions.

- Customer Support: Reliable customer assistance through multiple channels can be vital during the starting phase.

Steps to Choose the Right Trading Platform

The steps to choose the right trading platform are:

- Identify Your Trading Goals: Clearly define what you seek to achieve. It can be long-term investments, short-term trading or portfolio diversification. Your objectives will determine the ideal platform features and tools.

- Research and Compare Options: Based on your goals, create a shortlist of platforms and compare fees, features, tools, asset classes, and accessibility options. Check reviews and forum feedback for user experiences.

- Test the Platform: Leverage free demo accounts (if available) to test the interface, trade execution speeds and tool availability first-hand.

- Evaluate Accessibility: Assess accessibility across frequently used devices like desktops, tablets, and smartphones for flexibility. Mobile trading allows one to capitalise on opportunities at any time.

- Start Small: To get used to trading, begin with small volumes. This can help build confidence alongside experience. Once you feel comfortable, you can scale the activity levels.

Conclusion

Selecting your first trading platform can lay the groundwork for accomplishing your financial objectives. As a novice, one should prioritise user-friendly and secure platforms that aid skill-building through educational materials without hidden costs. The right foundation can fuel future growth. Making an informed decision can help trade effectively, scale the strategies and strengthen presence across financial asset classes over time.