Despite statements from the US president claiming that the country’s financial system is secure, bank shares fell on Monday all across the world.

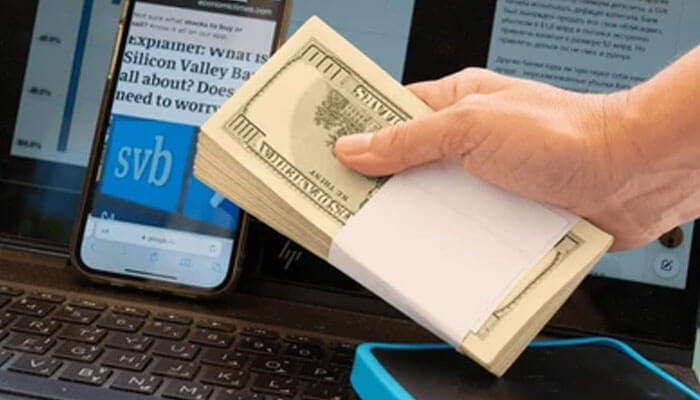

That comes following the failure of American lenders Silicon Valley Bank (SVB) and Signature Bank, which required government intervention to save consumer deposits. Joseph Biden pledged to take “everything is necessary” to safeguard the financial system. Investors worry that the impact could yet affect other lenders and cause severe declines in share values throughout the globe.

Commerzbank in Germany and Santander in Spain both had share price declines of more than 10% earlier on Monday.

Some smaller US banks saw even greater losses on Monday than their European counterparts, despite telling their clients that they had more than adequate liquidity to guard against shocks.

Because of the volatility, there is speculation that the Federal Reserve of the United States will now postpone its plans to maintain raising interest rates in an effort to control inflation.

Mr. Biden stated that when the government intervened to fully secure deposits made with Silicon Valley Bank, individuals, and businesses will be able to access all of their funds as of Monday.

Why did the Silicon Valley Bank fail?

Silicon Valley Bank was shut down by US regulators on Friday after they confiscated its assets. Silicon Valley Bank specialised in lending to technology companies. It was a US bank’s worst failure since the 2008 financial crisis.

It had been attempting to raise money in order to cover a loss on the sale of assets impacted by rising interest rates. Customers rushed to withdraw money as soon as they heard about the problems, creating a cash shortage.

Mr Biden stated that covering the funds would not cost the taxpayer anything, instead being paid by fees regulators charge to banks.

US authorities also introduced a new method for banks to borrow emergency capital in a crisis as part of measures to regain confidence.

The failures, which followed the demise of another American institution, Silvergate Banks, last week, have raised concerns that they may be an indication of problems at other businesses.

The US government “moved forcefully to avoid a contagion emerging,” according to Capital Economics’ Paul Ashworth.

Bottom line

Authorities also seized control of New York’s Signature Bank on Sunday. This institution was seen to be the most prone to a similar bank run because it had a large number of cryptocurrency-related clients.