If you’re new to cryptocurrency mining, you need to understand the basics of hash rates. This will help ensure decisions made about your mining setup or hobby are informed by knowledge and understanding. In this article, we’ll cover all there is to know about the Hash Rate in Bitcoin —from what exactly it means to how electric costs can affect profitability. Once you have a better grasp on hash rates, you can make the best-informed decision when setting up your pitfalls of bitcoin trading.

About Hash Rate

In essence, the hash rate is how quickly a mining device can solve the cryptographic puzzles of cryptocurrency mining. Miners compete to guess the correct answer within a block, and whoever wins gets rewarded with digital tokens from that particular blockchain network. The higher your hashing power, the faster you can make accurate guesses, thus increasing your rewards in return. Solving a Bitcoin block and receiving the 12.5 BTC reward using an outdated laptop is theoretically possible, but with today’s difficulty rates, it would require three-quarters of a million years to solo mine one block alone; this explains why no sane person mines Bitcoin using their CPU.

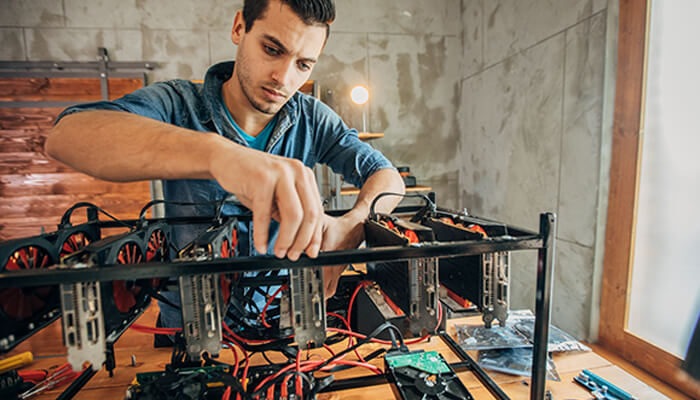

The odds are akin to being struck by lightning on a sunny day, thus making mining much less feasible than simply purchasing cryptocurrency instead. When researching a crypto mining device, such as an ASIC miner or GPU card, you may come across the hash rate. This denotes how many calculations per second the device can perform to solve blocks and consequently earn rewards.

Are all hash rates equal?

The hash rate of bitcoin mining devices differs drastically when compared to others designed exclusively for mining cryptos like Ethereum since each crypto is built on a unique algorithm. For example, Bitcoin’s SHA256 algorithm has relatively low memory requirements and consumes computing power; it only needs hashes in the terahash range or higher to be mined effectively today.

If we make a comparison between Bitcoin and Ethereum, you’ll find that most modern Ethereum mining devices (usually GPUs) generate in the mega-hash range. It may seem like the Bitcoin mining device is more powerful or reliable at first glance due to its capability of producing higher hashes using SHA256. However, this comes with a consequence: the network difficulty is much tougher for Bitcoin as it is equipped to easily produce computations.

It can be confusing to understand the effectiveness of a mining device because some cryptocurrencies use difficult algorithms that only basic CPUs can mine. A high hash rate is demanded and competitive amongst these networks, yet mining efficiency isn’t simply determined by looking at how many hashes per second it generates. To find out if your miner is truly performing as desired, you must consider both the network difficulty and the normal hashing rates for that specific cryptocurrency’s miners.

What is the electricity cost of mining equipment?

When it comes to mining profitability, there is one key factor that must be taken into consideration: the efficiency of your miner. With electricity costs involved in nearly every part of Bitcoin mining operations, a high-efficiency miner is essential for making a profit. In years past, GPUs were commonly used in cryptocurrency mining; however, today, attempting this approach would be highly unprofitable due to poor hash rates and expensive electrical costs per unit mined.

ASIC miners are popular among crypto miners for their high hash rate and low relative energy cost. Efficiency is key to getting the best return on investment, as a higher hash rate doesn’t necessarily translate into better profits if it comes at an elevated energy cost. A machine offering 10% more hashes but with 50% increased power consumption would not be efficient or profitable.