According to the Federal Reserve, online personal loans are starting to become much more mainstream than people have initially thought. This is considered to be due to the data driven world now helping people create better financial options for themselves regarding managing their credit, getting better loan rates to have more leverage at car dealerships, and debt consolidation.

As of a recent 2017 poll conducted by Fed Small Business nearly 1 in for people (24%) whom sought loans did so through online lenders, and in fact the market seems to jump quite substantially each year with next year projections estimated to be closer to 30%.

Why is there a Transition in the Market to Seek Loans Online?

Whether they’re small business loans, auto loans, payday loans, small cash loans, or medium sized cash loans of $10,000 and more, the market has become aware that consumers are in need of more options than ever.

The momentum that is causing a popularity boost in online loans very may well be a mixture of higher rotating debt than ever, and the desire for convenience. As of 2017 the US Census Bureau estimates that the average American is carrying between $38,000- and $59,000 of debt.

The truth is in the history of our country, our debt has never been so high, and that’s due to host of other things that are a subject for another article. That said our GDP continues to sore and interest rates on loans are at an all time low, leading consumers to take advantage of a marketplace that’s rewarding them for managing their finances in a new way.

How Internet is Revolutionizing This Segment?

One of the ways the marketplace is rewarding consumers is by offering loans of $10,000 and more online. This circumvents a lot of typical issues that most people experience when borrowing from banks and credit unions.

While certain terms and service do apply that you can come to expect, such as credit checks, requirements of regular income, etc, this process is becoming simpler, faster, and for some more affordable than typical financing they’d receive from a typical financial institution.

People with bad credit are receiving approval on loans they may not otherwise have received and at rates that may be more manageable with terms in their favor for repayment. Getting a $10,000 loan online can be simple and safe thanks to the growing network of trustworthy lenders online.

Conclusion

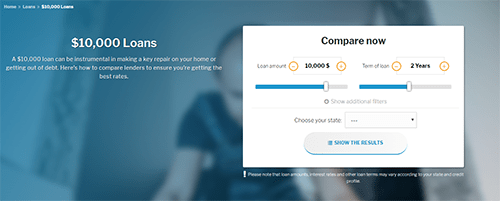

However as these loans become more popular it is important to note that you make sure to do your homework and shop around for the best rates. Financer.com offers $10,000 loans by providing a network of established direct lenders that you can compare to see what works best for your financial situation.

And that’s just one of many resources you can visit when you’re looking for a $10,000 loan online.