It was over a decade ago that cryptocurrencies made an entry into the financial sector via Bitcoin. Since then, there have been bullish and bearish market trends, causing investors to make profits or incur losses. Good luck with your investment and immediate experience here.

Nonetheless, the fans continue to grow, and many beginners are waiting to plunge into the world of virtual currencies. After all, the marketplace is still a lucrative one. Investment is easy, thanks to the presence of Bitcoin Smart, the intelligent trading and investment platform.

Here are five innovative ways to garner profits via investment in digital currencies.

Dividends

The investor must have some basic knowledge of bonds and stocks. Then, the person will comprehend the concept of dividends too. They refer to cash payments that go to shareholders. The amounts are small, as they must be distributed equally amongst all the stakeholders. In other words, the company splits the profits gained for the concerned quarter. The company makes every stakeholder a part-owner of the company.

Lending

Investors may even opt for lending cryptocurrencies to trustworthy borrowers, especially if they have sufficient funds. The borrower must agree to pay interest on the amount borrowed. The rate is in alignment with the type of coin or token that is borrowed, as well as the amount borrowed. The lending may take place on specific platforms, like P2P (Peer-to-Peer), DLP (Decentralized Lending Platforms), Centralized platforms, etc.

Staking

It is a method evolved by the cryptocurrency world to ensure that investors make good profits. Here, an investor’s digital wallet must display a certain number of tokens or coins. They must be available in the wallet for a specific period. Based on the type of digital currency hoarded and the quantity of tokens or coins, the investor gains monthly interest. It is a generation of passive income.

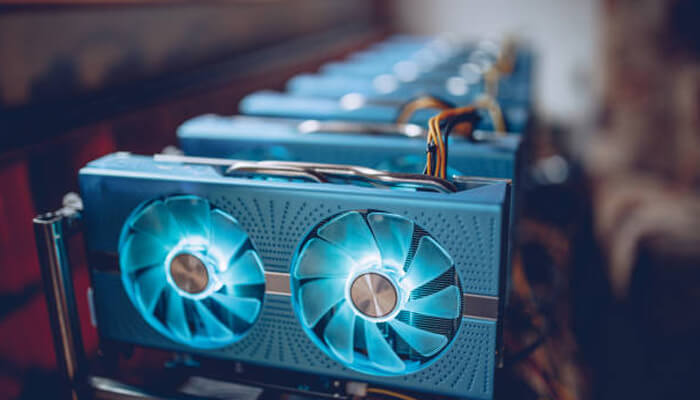

Mining

People with a good affinity for mathematical problems should try mining. All that is required is specialized hardware. Alternatively, they may opt for cloud mining services, where there is no need to buy hardware or maintain it.

What happens is that miners resolve complex problems, thereby validating blockchain transactions. This way, they can add new blocks of data to the existing ones in the chain. Their efforts fetch rewards in the form of virtual currencies. However, those who opt for hardware mining rather than cloud mining services receive better rewards.

Airdrops

It is a great way to access tokens or coins without paying anything. This way, investors may begin hoarding their favorites. Whenever there are token launches or traditional sales, people must spend some money upfront or make a deposit. In contrast, airdrops are synonymous with free distribution.

Users may interact on social media, sharing information about airdrop projects. Alternatively, they may join an online community. Sometimes, there are simple tasks to be fulfilled, like watching educational videos. They are all different ways of benefiting from airdrops.

Other Ways of Earning

The above-mentioned methods are the best ways to earn via cryptocurrencies. However, there are other ways too.

Investing

Ethereum, Bitcoin, Solana, etc., are top-class coins. They are coveted by all crypto enthusiasts. They may purchase varied digital currencies and store them in their digital wallets. They prove useful when confronted with a cash crunch, for investors may sell them at high prices.

Alternatively, users may link up with a cryptocurrency index fund by paying some money. This way, they get to diversify their respective portfolios. Even risks lessen since they are spread across the portfolio.

Trading

Investing offers long-term profits, for it operates on a purchase-and-hold strategy. Trading offers opportunities to earn short-term profits.

True, the global cryptocurrency marketplace is highly unpredictable. One never knows when the price of a digital asset will rise or fall. However, if an investor possesses excellent analytical and technical skills, there is every possibility that wealth will just flow into the wallet.

Buying the Dip

Here, investors may purchase any type of cryptocurrency asset from a well-known cryptocurrency exchange. Whenever there is a decrease in the price of any coin or token, the urge to buy more may be fulfilled. The crypto world refers to it as buying the dip.

Investors may hoard their coins or tokens for as long as they want, keeping a vigilant eye on changing market trends. When they finally decide to sell, they may expect excellent returns.