A janitorial business requires workers to enter commercial and residential spaces to perform services. This could introduce liabilities such as property damage and theft. Liabilities could emerge at any time and place the company in jeopardy. Proper insurance coverage helps the business owner eliminate these risks and keep them and their workers covered. Where the business is headquartered determines if the owner needs coverage for their property and assets stored in it. Exploring insurance policies helps janitorial business owners choose the best insurance for the company and its workers.

Why You Need General Liability Coverage

General liability coverage protects the janitorial business against liabilities. When cleaning properties, a common normality is the possibility of property damage. If workers damage the property, the property owner can file a claim against the business. The service provider must clean the property as expected, and if they are cleaning a commercial property, the business must follow updated sanitation measures to eliminate greater risks to the client’s customers. Failure to complete the services as expected could lead to a claim if they expose a customer to a health hazard. A janitorial business owner can get services at Garrity Insurance and find out more about liability coverage.

Well-Defined Worker’s Compensation Coverage

Worker’s compensation coverage is required for all businesses that hire over one worker. The federal law doesn’t offer exceptions for relatives working for the business owner. Even if the workers are relatives, the insurance coverage is necessary. The insurance covers medical expenses and replaces wages if the worker cannot come back to work immediately.

The terms of the policy require the employer to send the worker to an emergency room or urgent care facility for a full assessment. Their doctor completes a medical report, and a claim’s adjuster reviews the findings. The claims adjuster must approve the worker before the employee receives any wage replacement funds. The adjuster must also determine that the worker was following all company safety policies when they were injured, and the worker was within the workspace when the accident happened. The replacement wages won’t exceed 90% of the worker’s normal earnings. The claim defines how long workers receive the replacement wages, and when they are expected to return to work.

Commercial Auto Coverage

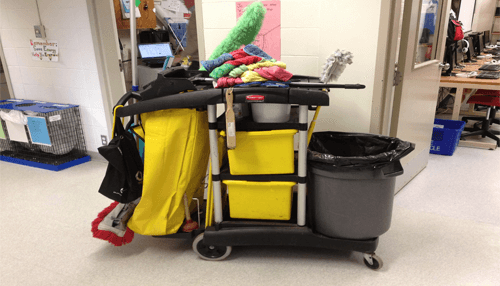

Coverage for all commercial vehicles is a must when performing janitorial services. The vehicle contains all cleaning supplies and equipment. If the worker is involved in an accident, the company could lose more than the vehicle. They need adequate coverage to pay for personal injuries and replace any equipment they lose because of the accident. Additionally, the worker could get exposed to harsh chemicals during the accident. The same is possible for a driver or passengers in a vehicle that collides with a commercial automobile. Assessing these risks shows the business owner what coverage level they need and what additions they need for cargo and supplies.

Janitorial Bonds for Workers

Janitorial bonds for workers protect the business owner and their workers against the unexpected. When cleaning residential homes, there is a risk of theft and allegations of theft. If anything appears to be missing, the homeowner may file a legal claim against the company. Allegations of theft involving money or any items in the home could present several pitfalls for the business owner. Whether true or not, a public lawsuit destroys the janitorial company’s reputation, diminishes their credibility, and implies that their workers are criminals. Securing janitorial bonds for all workers eliminates the liability, and the business owner can file a claim to settle with the client out of court.

Commercial Property Insurance

The commercial property insurance protects the company’s investment in their property. Insurance provides funds to repair property damage or replace the entire property if there is a total loss. Property damage or total loss must happen due to events covered under the policy. This includes fires, criminal acts, and natural disasters. It is a good option to hire a public adjuster like AllCity Adjuster to handle the entire claim process from start to finish. The claims adjuster visits the property any time a claim is filed, and the property owner must report the damage by a specific deadline. If they miss the deadline, the owner won’t get the coverage as expected.

For example, if there is a flood or a water pipe burst, the property owner must hire a contractor to repair the issue and give them an estimate for all services required. With a water leak, mold could develop inside walls, ceilings, and floors. If it isn’t found quickly, the mold spreads and causes more profound property damage. Property insurance could restrict coverage if these conditions aren’t reported to insurers quickly.

Additionally, if the property is inside a designated flood zone, the property owner must purchase supplemental flood insurance. Properties in flood zones are not fully covered by a standard insurance policy.

Renter’s Insurance Coverage

If they rent the commercial space, the janitorial business owner needs renter’s insurance to cover property damage caused by them or their workers. It will also cover items the business stores in the location, including equipment and cleaning supplies. Any machinery, electronics, or furnishings the business brings into the property are covered by the renter’s policy. The policy provides coverage for liabilities related to customers visiting the business. The coverage prevents financial losses for the business owner and prevents them from losing their security deposit when they vacate the rental property. They can add riders for any items the business rents from vendors to prevent premature replacement costs.

Janitorial businesses provide invaluable services to business owners and homeowners. The service requires workers to enter the property during and after business hours. This could increase liabilities related to workers and increase the risks for the business owner. However, they use their commercial space to define what policies they need to protect the property and items they store in it. All vehicles used for the business require commercial auto coverage and riders for cargo stored in the vehicle. If the owner uses the vehicles for personal use, they may need personal auto coverage too. Reviewing business-related policies shows owners how to protect their janitorial business.