Retail trading has increasingly become a sought-after vacation in the financial landscape for novices and seasoned professionals. For potential entrants, an important consideration is accurately gauging the necessary capital to embark on such a venture. It’s not, however, solely about pinning down a numerical value. Trading is intertwined within a broader global financial environment, which is characterized by rapid changes. The retail trading arena incorporates a massive pool of intricately connected elements shaped by a myriad of macroeconomic variables.

Markets are affected by geopolitical scenarios, groundbreaking technological innovations, and dramatic shifts in monetary policies by major world players. The Fed, ECB, BoE, and other monetary authorities play their part in market dynamics.

The fluctuating fortunes of the global economy are as variable as Mother Nature. Moreover, with inherently intricate trading dynamics, individuals need to begin their financial preparations with a comprehensive understanding of global events. Doing so ensures a well-informed entry and paves the way for a sustainable and strategic approach to retail trading.

Forex Market Dynamics and Retail Trading

With its immense liquidity and volume, the global forex market sees trillions of dollars exchanged daily. Without a doubt, forex trading is the world’s largest financial market. It operates continuously and draws a diverse crowd, from national governments and major financial institutions to individual retail traders.

The vastness of this market presents both unparalleled opportunities and inherent challenges. For aspiring retail traders, a deep understanding of the market’s intricacies, coupled with a well-planned capital strategy, is essential to navigate its complex landscape successfully. Many important concepts need to be grasped, notably leverage, margin and spread. But the essence of forex is trading one currency in a pair for another.

Understanding Central Banks’ Role: Fed and ECB

The U.S. Federal Reserve, one of the world’s most influential central banks, has an essential role in setting monetary policy, which inevitably impacts forex dynamics. Recent remarks from the Fed Chair, Jerome Powell, indicated that the body is prepared to increase interest rates further to manage inflation. Such decisions influence the U.S. economy and ripple across the global forex market. When the U.S. raises its interest rates, the U.S. dollar often strengthens (all else being equal), affecting currency pairs and trading strategies.

Similarly, the European Central Bank (ECB), led by Christine Lagarde, has been proactive in managing still-high inflation. Interest rates within the European Union are poised to remain elevated to counteract inflation, with the ECB benchmark rate rising from minus 0.5% to 3.75% within a year. Such drastic changes could send shockwaves through the EUR/USD currency pair, one of the most traded in the forex market.

The Federal Reserve and the European Central Bank have historically targeted a 2% inflation rate. This rate is perceived as an equilibrium point that fosters economic stability without stifling growth. Powell’s recent communications hint at the Federal Reserve’s commitment to bringing inflation back in line with this target. Similarly, despite the tumultuous economic landscape and the challenges presented by high inflation figures, Christine Lagarde reiterated her backing for the ECB’s 2% inflation target, underscoring its importance in policy considerations.

Key Economic Indicators

Apart from central bank decisions, several economic indicators can sway the forex market. Retail traders must stay updated on inflation rates, employment figures, GDP growth and more. For instance, inflation in the eurozone recently dropped from a peak of 10.6% to 5.3%, primarily due to energy prices declining. Such shifts can provide trading opportunities, especially for those adept at fundamental analysis.

Geopolitical Challenges

The global landscape is fraught with geopolitical tensions, with events like Russia’s invasion of Ukraine causing significant disruptions. Such geopolitical events can cause currency volatility, especially for currencies directly linked to the involved nations.

Technological and Structural Shifts

Christine Lagarde highlighted the need for an increased focus on renewable energy investments, hinting at the shift away from fossil fuels. Such global changes directly impact economies and, by extension, currency values. For example, countries leading in renewable energy might strengthen their currencies due to increased investments and positive global sentiment.

The Retail Trader’s Capital Considerations

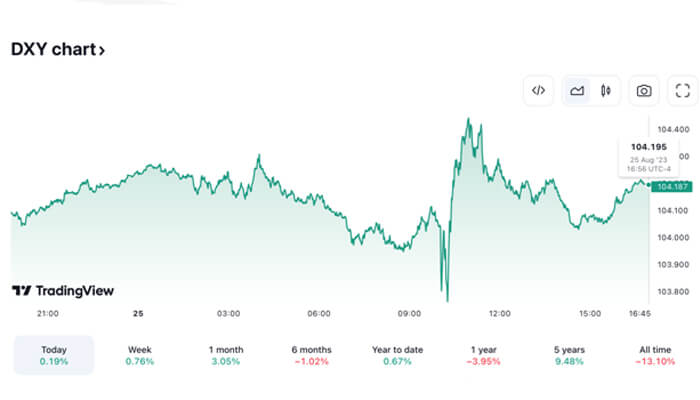

Entering the forex market as a retail trader isn’t just about understanding global events and strategies. It’s also about assessing how much capital you need to start and sustain your trading journey. While there’s no one-size-fits-all answer, factors like the trader’s risk tolerance, expected trading volume, and preferred currency pairs play crucial roles. Moreover, with the U.S. Dollar Index (DXY) standing at 104.19, traders must be adept at interpreting such indices’ implications for broader forex movements.

Wrapping it Up

In conclusion, retail trading encompasses a captivating blend of knowledge, strategy, and real-time responsiveness to global occurrences. From central bank policies and their implications on currency strength to grasping the nuances of economic indicators and geopolitical events, a retail trader’s journey is one of continuous learning and adaptation.

As the financial landscape metamorphoses, driven by technological innovations, geopolitical shifts, and economic strategies, the astute retail trader must recognize that capital considerations go beyond mere numbers. They envelop a holistic understanding of the market, dedication to ongoing education, and an unwavering commitment to strategic agility.

As traders position themselves within this dynamic environment, their success will be anchored not just by the depth of their pockets but by the breadth of their market insights and the resilience of their strategies. That’s the Holy Grail of market dynamics.