Although self-employment generally lacks the job security and consistency of a salaried nine-to-five, being your own boss comes with a fair number of perks. Being able to set your own hours, part ways with difficult clients and call all the shots can be a welcome change of pace for people who are used to traditional workplace settings. However, since many self-employed individuals experience dead periods, it’s important for them to properly conserve resources and think several steps ahead. Self-employed members of the workforce looking to preserve – and bolster – their finances would do well to avoid the following mistakes.

Needlessly Renting Office Space

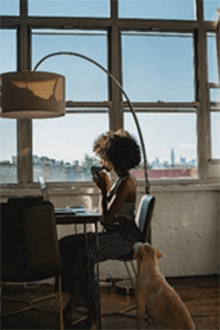

It’s easy to see why many self-employed individuals feel the need to rent office space. It loans an air of professionalism to one’s operation, which is certainly a plus when it comes to winning over prospective clients. However, unless you have a large number of employees, there’s no sense in wasting money on office space. Not only will the rent eat up a sizable portion of your monthly income, the operating costs will force you to part with even more money.

If you are your sole employee or you only have a few people working under you, it’s in your financial best interest to nix formal office space altogether. In the digital age, there’s very little reason for a self-employed individual to rent an office. These days, there’s no shortage of ways to touch base with clients and employees and ensure that everyone remains on the same page. Running things from the comfort of home will eliminate the need for cumbersome commutes and make the work experience considerably less stressful. As an added bonus, allowing any employees and contractors to operate from home stands to increase productivity and overall quality of work.

Not Taking Advantage of Small Business Discounts

A fair number of self-employed individuals don’t realize that they meet many vendors’ definition of small businesses. As such, they wind up needlessly paying retail for products they could’ve purchased at a significant discount. So, if you’re unclear on whether the vendors you work with consider you a small business unto yourself, don’t hesitate to ask. Taking the time to make a simple inquiry stands to save you hundreds of dollars a month.

Furthermore, don’t be afraid of trying to haggle with vendors. You’d be surprised by how readily some businesses will offer discounts in response to simply being asked about them.

Being Too Selective About Clients

Being able to choose which clients to take on is among the perks of being self-employed. Still, it’s possible to overdo it. If you find a client morally reprehensible or impossibly difficult, you are well within your rights to refuse their business. However, if you’re opposed to working with a client for vague or poorly-defined reasons, you’d do well to examine the situation from the outside-in to determine what you find so disagreeable about the client in question. If you can’t think of a good reason to refuse their business, simply accept the work and enjoy the additional income. Many self-employed individuals don’t have the luxury of being picky with regard to clients.

Failing to Save for a Rainy Day

For many of us, self-employment is a matter of “feast or famine.” There are periods where work is plentiful and periods where it’s practically nonexistent. You can help soften the blow of the latter by building up a solid rainy-day fund. In addition to setting aside as much as possible when times are good, you should also consider making some smart investments. Precious metals, for example, can help give your finances a boost. If you have a fair amount to spend, a 1 kilo gold bar might be a good starting point.

It’s not hard to see the appeal of self-employment. After all, everyone longs to be their own boss. However, not everyone has the follow-through to make this dream a reality. Furthermore, being self-employed often requires one to assume a higher level of responsibility than they would at a standard desk job. Whereas other full-time members of the workforce are able to count on regular paychecks, the amount of money made by self-employed individuals tends to vary from month to month – which it’s particularly important for them to avoid the blunders discussed above.