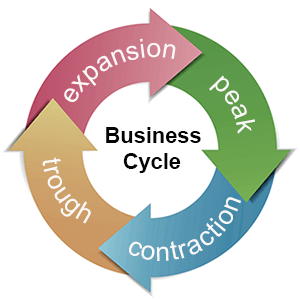

While the cause of an economic cycle to this day is still a hotly debated topic amongst economists, the one thing that can be agreed upon is the economy experiences periods of growth and recession in a cyclical nature. This cycle has been broken down into four distinct phases: expansion, peak, contraction and trough. During expansion, there is increased employment, economic growth and upward pressure on prices, which eventually comes to the highest point of the Business Cycles known as the peak.

After a peak, the economy typically contracts, entering into a correction during which growth slows, employment declines, and pricing pressures subside. The trough is the point at which the economy has hit a bottom, and is the point from which the cycle starts itself over again.

At the heart of every entrepreneur’s aspiration for their business is longevity. Few people start a company without the intention of watching it evolve over the years, surmounting obstacles and growing to celebrate the years in business and eventually decades.

However, in order for any entrepreneur to have their business not only survive but also thrive, they must be aware of the inevitability of business cycles and be able to effectively navigate them.

Stephen Bittel, founder and chairman of Terranova Corporation, has managed to master such navigation tactics. Terranova is currently in its 41st year of business and has grown from Bittel’s home office to become one of the top commercial real estate companies in Southern Florida.

In that time, the company has made its way through six recessions including the one that is currently ongoing as a result of the coronavirus pandemic, and thanks in part to Bittel’s leadership has come out of each one stronger than before.

Below, we explore how the business has handled some of the major recessions and what Bittel believes is the right course of action for doing so.

Born and raised in Miami, Bittel was a product of the Miami-Dade County public school system, attending from first grade through to his senior year of high school. Seeking experiences vastly different from what he had grown up with, Bittel decided to attend university in Maine at the highly selective liberal arts school Bowdoin College.

A fish out of water, although he initially felt overwhelmed by the demand for academic rigor of a private university in comparison to his public school education, he was eventually able to adapt to the school’s demands and graduated magna cum laude from the university in 1978 with a degree in economics.

During his final year at the college, Bittel was awarded the Thomas J. Watson Fellowship, a grant that enables graduating seniors to pursue a year of independent study outside the United States.

Although Bittel returned to Miami after his year abroad, his time at Bowdoin College and traveling had broadened his perspective significantly. His father and grandfather were both lawyers, and when he returned home he initially still intended to follow in their footsteps, enrolling at the University of Miami School of Law.

However, in order to support himself he also took a position at a commercial real estate firm and quickly developed a solid understanding of the markets.

This aptitude for business saw the company offer to take him to commission-based compensation at the beginning of his second year of law school, but by that point Bittel realized that his passion truly lay in business rather than law and in 1980 made the decision to instead start his own business.

Building Terranova from his home office while still attending law school, the company’s first logo was created by an art student from the University of Miami, and its first investments were in “friends and family” syndications of two small unanchored strip shopping centers down the street from the wine and gourmet store started by his grandparents in the 1950’s.

Although Bittel did graduate with his law degree and pass the bar exam in Florida, by that time his company was already two years old and he never pursued a career in law.

Although he started the business in the midst of a recession with a negative net worth and severe undercapitalization, Bittel learned early on that managing your balance sheet as well as your cash flow was critical to staying afloat in these times.

By the late 1980’s Terranova had not only grown out of his home and into an office but had navigated the so-called “double-dip” or “W-shaped” recession of the early 1980’s.

During that time the housing market crashed under the crushing weight of the 17-18 percent mortgage rates, but Bittel was able to steer his company through it by offering management services to insurance companies and banks who had involuntarily become owners of commercial real estate when loans defaulted.

After the brief recession of the early 1990’s, there was a decade-long period of economic growth, and Bittel saw to it that Terranova took advantage of that.

He grew the company’s portfolio significantly in that time by purchasing entire shopping centers and strip malls in the municipalities of Miami-Dade County, and at their peak had a property base of over 8 million square feet.

As young and growing families sought the extra space and affordability of suburban areas, there came with them a demand for grocery stores, pharmacies, and popular chains that were more easily accessible without having to drive into town.

By developing relationships with chains such as Publix, Walgreens and Starbucks, Terranova’s portfolio could grow exponentially while still remaining manageable through holding multiple leases with these same tenets, who also served as “anchors” for their shopping centers that would drive traffic to the other businesses within them.

The early 2000’s recession caused by the collapse of the dot-com bubble was relatively short and hit investors a lot harder than it hit most Americans, meaning it was mostly inconsequential for housing. However, while a recession didn’t drive a change in Bittel’s company in the 2000’s, another shift did.

Bittel noticed at that time that the younger employees of his company were choosing to purchase and renovate smaller, older homes in locations closer to the city center rather than the suburban areas where much of their property was located.

Indeed, from 2000 to 2010 more college-educated professionals aged 25 to 34 moved downtown than to the suburbs in 39 of the 50 largest United States metros, and for 35-to-44-year-olds the same held true in 28 of the 50 largest metros.

Getting ahead of this trend before it took off the ground, in the 2000’s Bittel made the decision to begin re-diversifying Terranova’s portfolio, choosing to focus on high street areas that were in places with walkable downtown cores.

Their first buildings were an eight-property portfolio on Miracle Mile, a stretch of the main east-west road in Coral Gables’ central business district, and the second urban location Bittel chose for development was Lincoln Road on Miami Beach.

The Lincoln Road purchase in particular made waves because Terranova paid $52 million for the property, coming out to $850 per square foot.

Many people were shocked that they would purchase at such a high price, but Bittel’s value investing principles meant he recgonized the trend of urban revival before many others did, and in 2014 they company made headlines again, but this time for being part of one of the largest property sales in the history of southern Florida, selling their property on the road for a staggering $342 million.

While the Great Recession of 2007 to 2009 was extremely hard on homeowners, Bittel’s foresight of investing in urban areas meant that even as homes were harder to purchase, his commercial properties continued to see growth due to the availability of rental properties in urban areas.

Bittel has said that times of contraction have usually been Terranova’s best chance to put their balance sheet to work. It is during these times that they have expanded their portfolio of assets through opportunistic acquisition of distressed debt and equity, and he has also stated that he wishes he had entered many of the down-business cycles with greater liquidity to seize opportunity.

We currently sit in another contracting phase of the business cycle, and Bittel is staying true to his word by seeking distressed opportunities in real estate and corporate assets.

Additionally, Terranova remains active in building their Lincoln Road Miami Beach and Coral Gables Miracle Mile retail portfolios back to pre-pandemic strength, and has also begun to diversify their portfolio again with gas station, convenience store and car wash assets, adding a newly rebuilt store every year. When you are starting a business, it can be easy to envision how you will thrive during periods of growth in the economic cycle.

However, it is important to remember that what goes up must inevitably go down, and just as important is ensuring your business strategy is prepared for the inevitable down-business cycles that will come.