Whether you’re a novice or a pro trader, a successful trader always looks for ways to improve and optimize their trading strategies. As a result, you’re probably always looking for a way to keep a close eye on their investments. Unfortunately, this is not something that can be easily done using a traditional spreadsheet. In this article, we will explore some of the best trading journals available, highlighting their features and benefits to help you choose the right tool for your trading journals needs and elevate your trading practice.

Luckily for you, there are now cloud-based trading journals that can keep you up to date with news from a single device. As with everything related to finance and trading, not all tools are built the same or will give the same or even a good result.

In this article, we’re going to go over three different journals. If you’re looking for more options or a more detailed review, you can check out this article on the best trading journals on modest money.

The world of trading journals is fast-paced and if you’re serious about being a trader you don’t want to get left behind.

TraderSync

The first thing to note about TraderSync is that it’s AI-powered. What that means for you as a trader is that the decisions it’s making and reports it’s showing you are by in large emotion-free. Essentially, AI allows for the most optimized technical trading analysis.

A result of being focused on using AI-powered machine learning is that without your input it won’t give you an idea of the market overall. That being said, TraderSync does allow your trade data from multiple trading accounts and automatically provides a wide range of reports on them. These reports include things like pricing reports, volume reports, and setup reports.

Additionally, unlike many other trading journals, TraderSync gives information on forex as well as the traditional stocks, futures, and options reports provided by another platform. However, TraderSync does have some limitations in terms of tools available for creating reports and tracking. These limitations can be a hindrance if you are an advanced trader, but for intermediate and beginner traders it can be helpful to learn the fundamentals first.

TraderSync is also largely focused on day traders, so if you’re someone who likes to go long with position it might not be the best option for you. However, it is quite an affordable journal coming in at $29.95 per month.

Edgewonk

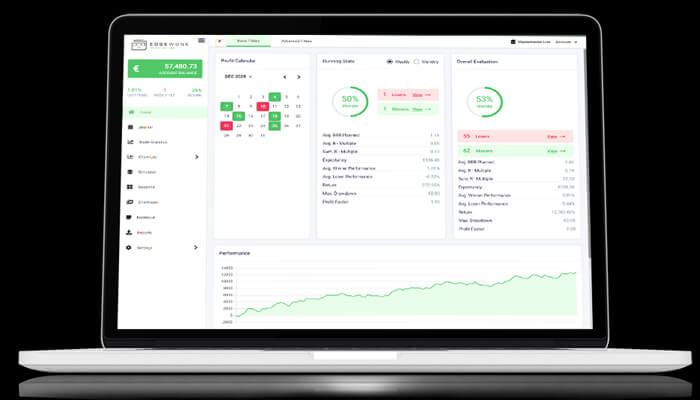

Edgewonk is one of, if not the most customizable, trade journals available for subscription in the marketplace today. For traders with a lot of trading activity and versatility in the type of trading that they do, Edgewonk is an ideal platform.

Edgewonk supports stocks, forex, futures, options, and CFDs as part of its flat-fee tracking. Although they do make a yearly payment, by opting into it you gain access to track unlimited trades and use their trade simulator which can be a great way to develop strategies and predict future trading performance.

The only downside you might experience using Edgewonk is the high barrier to entry in terms of knowledge. They offer a variety of tools and features which can seem daunting even for intermediate traders. However, with the ability to use the variety of tools available you can quickly increase your trading knowledge simply through trial and error on their simulator.

Trademetria

Trademetria is suited to casual traders instead of active traders. In contrast to other platforms, you have to manually enter all of your previous trades, meaning no real-time feedback or support. If you look at TraderSync’s approach to technical analysis, Trademetria is on the other side of the coin focusing on fundamental trading. In other words, they are looking at longer-term positions.

As a result of their focus on fundamentals, they offer an array of analytical tools to help you understand and navigate the market better. This includes features such as their trade simulator and backtesting, which are aimed at helping you make more profitable trades.

A note to make about Trademetria is that they are probably not a good fit for you if you’re looking to become a day trader, as the lack of automation can be a hindrance for off-the-cuff trading.

Which one is worth it and do I need a trading journal

Being a successful trader does not require a trading journal, it can be extremely helpful if used correctly. At the end of the day, it’s a tool that many people find a tangible use for. Trading journals ultimately are designed to give you, as a trader, a competitive advantage through access to curated information that would otherwise be very hard to come by.

If you’re still looking for tools that can give you an edge, you should check out this article about the 5 best stock screeners. Or if you’re already comfortable trading or aspiring to be a trader full-time and want to generate additional income, you can check this article about the best-funded stock trading accounts for aspiring traders. Yes, companies will give you money to make more money.