Importing goods into the UK means that you are going to have to get through customs. For anyone who regularly travels or imports, you’ll know that this isn’t always an easy process, especially if you’re inexperienced.

However, in many countries, customs are there to protect a mutual interest and as a result shouldn’t be feared. As long as you play by the rules, you can get through with minimal stress, hiring a professional international freight forwarding company to handle it for you can make it even easier.

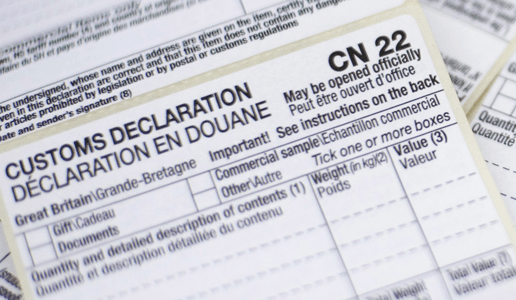

Custom Clearance Paperwork

One of the first hurdles you will face to ensure that your items aren’t withheld, late or refused is to make sure that all of your paperwork is correctly filled in.

Several items will require you to have a certificate or license, particularly if they are a firearm or any kind of weapon.

Documents everybody needs:

- Bill of Lading

- EORI Number

- Commercial Invoice

- Packing List

Types of certificates you might need:

Original Certification of Origin

Items such as textiles will need this certificate to provide evidence of their country of origin. As suggested by the name, this certificate is issued by the country from which the item is coming from. In most cases you will only need to have a certificate issued by a local Chamber of Commerce, however depending on the country issuing the certificate and other influential factors, it may be issued by a local council or localized government body.

This certificate is used all over the world by many varying countries and is by no means solely used by the UK.

CE Certificate

This is just to confirm that all your goods meet the required standards expected for products entering the EU.

Certificate of Port Health

This one will probably be needed if the goods you are seeking to import are edible or used with food and drink.

Test Certificates

Some products, particularly electricals, might be stopped by Trading Standards to ensure that they are safe. Test certificates enable you to prove that you’ve had your items officially tested.

MSDS

Material Safety Data Sheets are essential to accompany any hazardous shipments.

Import/Export Licenses

Some products may need licenses to bring them into the UK. While this is only a select few, products often need licenses to get them out of their country of origin.

Double Checked Items

Go through each item that you are planning to import into the UK and check the following things:

Do they conform to trade standards?

Trading Standards exist to make sure that goods arriving in the UK are of an acceptable quality. They take into consideration several different factors such as safety, animal welfare, authenticity, correct labeling, and accurate weights and measures.

Do they fall into the anti-dumping duty category?

Anti-dumping duty is a charge placed upon people attempting to bring goods for cheaper prices from foreign suppliers than they would pay in the domestic market. This helps to protect the economy of your home country and is only applied once the goods make it to the UK border. You will need to pay this for your goods to be released.

Is the item certified?

Some items need to certification. Some examples of items that might need certification are:

- Animals

- Plants

- Textiles

- Chemicals

- Food

- Drink

- Cooking Substances

Prepare for Payments

Before arriving at UK customs, you need to be aware of how much you need to pay for all the goods that you are planning to bring through customs. Some of the main charges include VAT, customs duty, and excise duty. If you can’t pay for whatever reason you will be unable to collect your goods.