Introduction

Cash flow management software controls the inflow and outflow of cash inside a company. Organizations deploy cash flow management software for controlling the inflow and outflow of the cash flows. They predict future earnings on the basis of previous operations. The organization works as per the past operational and financial information. The financial and accounting department deploys the cash flow management software. There are different software solutions that work for producing efficient financial analysis. For instance, invoice management software, forecasting, and budgeting software manage the finances of the organization. The cash flow management software works along with this software in the market.

Following we have enumerated the top 05 cash flow management software in 2022:

1. Casual – Cash Flow Management Software

Casual makes it simple to produce the financial analysis. You can share them with others via dynamic and graphical dashboards. In Causal, you build a model out of factors, that you can then connect using simple equations in plain English. Simple financial analyses are easily comprehendible. When you’re finished, provide stakeholders with the URL to your prototype. Graphical representation of the facts increases the confidence of clients in your work. Thus, artificial intelligence enables you to work on them in minutes rather than days.

2. Float – Cash Flow Management Software

Float is an excellent-quality and award-winning platform. It offers accurate and reliable financial analysis to the organization. In case you are paying the loans, the Float makes it easy to deposit the loan payments with its flexible and useful features. When opposed to worksheets, Float provides comprehensive and updated financial analysis. So, it requires a quarter of the effort to compile. Due to the accuracy of the Float financial analysis, your company will be notified of any cash shortfalls or overflows well in advance. It enables you to work efficiently in the upcoming future.

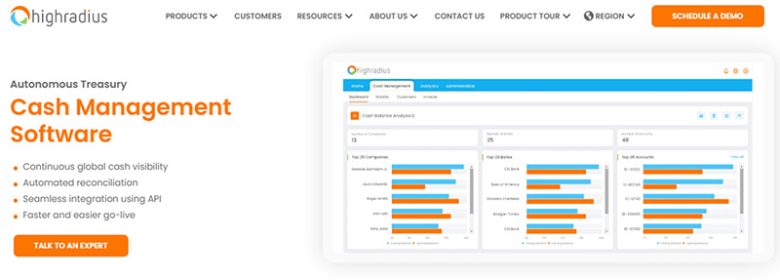

3. High-Radius – Cash Flow Management Software

High-Radius is a high-quality Fintech SaaS Company. The software utilizes the artificial intelligence system to assist companies in automating order-to-cash, treasury, or record-to-report processes. It is a data-driven artificial intelligence system that optimizes the working capital, enhances productivity, and increases the speed of financial processes.

We can develop strong cash flow projections that are graphical and understandable. They tend to offer a ‘real’ image. Our financial analysis reveals where a firm is heading in the short and medium term. The software uses the direct approach of cash flow management (scanning all data on bills, invoicing, and other activities).

4. Dryrun – Cash Flow Management Software

Dryrun mainly controls and manages the variable cash flow, sales, and growth situations. Our software offers greater flexibility in the automation of the processes. Users can get rid of those time-consuming spreadsheets by connecting to Sage Intacct, QBO, Xero, and Pipedrive. Users can make the best decisions with Dryrun. It is a program that forecasts your cash flow and sales. So, you can look ahead and make smarter decisions. Knowing your figures ahead of time reduces your risk and increases your profits. There will be no more unpleasant shocks.

5. Pulse Reliable and Best-Quality – Cash Flow Management Software

If you have a small business, loan payments can be a problem. However, you can utilize cash flow management software to produce a comprehensive and easy-to-understand financial analysis. Business owners can easily keep an eye on the lifeblood of your small company: your revenue. Pulse provides you with all the features you need to keep track of your working capital. Thus, you can repay your loan easily.

Conclusion

Cash flow management software offers great services to large, medium, and small companies. Artificial intelligence produces comprehensive and useful financial analysis. Thus, you can come up with an accurate projection. So, you can pay loans, earn more or revise strategies.