In many ways, crypto-trading can be likened to the growing and harvesting of crops. Since December 2021, the crypto market has been on a steady decline. A bear market is a frightening prospect, much like the winter that comes after the fruitful harvest season.

However, unlike the seasons, a bear market can be difficult to anticipate. It’s difficult to determine the length of their period and the extent of the impact on the crypto market. Here are some rules to keep in mind to help guard against portfolio losses during a bear market.

Don’t “Buy the Dip”

Over the years, “buying the dip” has become a meme in the cryptoverse. While there are scenarios when this can help you achieve greater gains, buying the dip during a bear market is extremely risky as most assets will only dip further. The differentiating factor between buying a dip properly and haphazardly is timing.

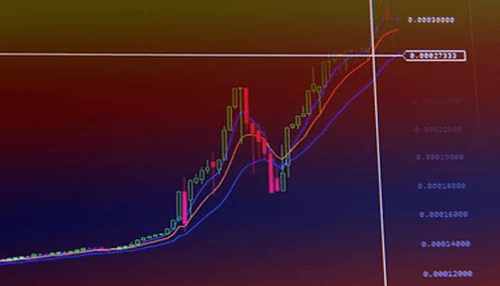

It’s important to take the time to watch for indicators that the crypto you’re about to buy is going to go through a reversal. Some indicators include high time-frame convergence, extremely high trading volumes, and key exponential moving average crossings.

Capitalize On Short Rallies

Even during a bear market, upward rallies can still occur. Rallies are caused by a significant increase in demand, which forces a large influx of investment capital into the crypto market. This causes the value of the asset to increase temporarily, only to be rejected by resistance levels (which are often EMAs).

Instead of buying the dip, you’d have a far better position by shorting short rallies. This is best accomplished through margin trading because these strong rejections can serve as potential points of entry for your money. Margin trading is available on major cryptos such as Bitcoin, Ethereum, and XRP. Just be sure that you buy XRP, BTC, or ETH from reputable MSBs.

Take a Break

It can be disheartening to find that a significant percentage of your portfolio has lost a lot of value, and your first instinct is to find a way to offset the depreciation of the value of your assets. However, the best action is sometimes inaction. This is especially important to avoid committing crypto-trading mistakes.

Cryptocurrency is not the wild card that it once was. Its potential is recognized, even to the extent that some countries accept crypto as legal tender. It’s not going to go away any time soon, if it goes away at all. This means that it’s perfectly fine to disconnect and to find other ventures. You can always come back when the market takes a turn for the better.

A bear market will test your dedication and belief on a project. It’s also the period when fear, uncertainty, and doubt is bound to circulate all over the internet. While most times, this is nothing more than misinformation, it’s important to always do your own research to separate fact from fiction.