Many graduates leave their college with a debt of $37,113 on average, which is one of the reasons why millennials aren’t becoming entrepreneurs. Starting a business with this amount of debt is risky. You might struggle with repaying the student loan debt while also trying to secure your business fund. Money Brighter is a digital portal that will help you manage your finances online with the use of tools and financial-based information

Luckily, it’s still possible to become a successful entrepreneur, even if you have a student debt hanging over your head.

In this article, we’ll tell you eight ways you can launch a business while paying off your student loan and not put yourself in more financial trouble.

1. Start with Low-Risk Business Ideas

Starting with low-risk businesses can save you time, money, and energy.

Therefore, consider choosing potentially low-risk business ideas, such as:

- Content creation. Including blogging, video production, and graphic design.

- Online courses and tutoring. Providing instructional eBooks or videos and real-time virtual lessons.

- Online shops. Selling handmade goods, like jewellery or custom stickers, and dropshipping.

Whatever ideas you choose to try, you will likely need a website for selling your products or services. And the first step is to choose a reliable hosting provider, like web hosting Hostinger. Then, purchase a domain name and set up your website with a CMS platform, like WordPress.

2. Review Your Student Loan Payment

Before thinking about the business funding, review some aspects of your student loan payments, such as:

- Federal or private loans

- Cost of the loan with the interest rates and fees

- Current credit score

- Loan discounts and limits

- Repayment options

Evaluating these points can help you plan and balance your financial flow. You may also notice opportunities to adjust the payments and get rid of the debt faster.

For instance, if you have a good credit score, consider asking the provider to lower interest rates or give a loan consolidation program. Otherwise, if you have difficulty paying back your loan, you can refinance. That would mean getting a new loan from a different lender with better terms to cover the existing loan. Students have the option to refinance with the Citizens Bank program.

3. Check the Student Loan Forbearance

If you’re worried about having little money at the beginning of your business, student loan forbearance can be an option. Meaning, you can pause the loan payments for a certain period, usually 12 months. Yet, interest rates will still be accumulated, so you may end up with a larger debt.

During the Covid-19 pandemic, federal student loans were automatically put in forbearance. Many private student loan lenders also offer this option, so contact your lender to ask for more information.

4. Maximize Your Capital

Even if you get the consolidation and refinancing, balancing personal expenses with student loans and business funding can be challenging.

To tackle this problem, try to minimize the expenses by avoiding dining out too often, biking everywhere, and seeking discounts and promotions.

If possible, consider multiplying your income streams, such as doing freelance jobs, listing your apartment on a space-renting platform, or joining an affiliate marketing program.

5. Explore Funding Options

Self-funding business is an option. However, it can be risky to run a business with limited resources due to student loans.

Luckily, there are other business funding options, including:

- Crowdfunding. Capital from many people to finance a business. It can be in the form of loans, donations, or product exchanges. You can get the money from family, friends, or online sites, like Kickstarter and GoFundMe.

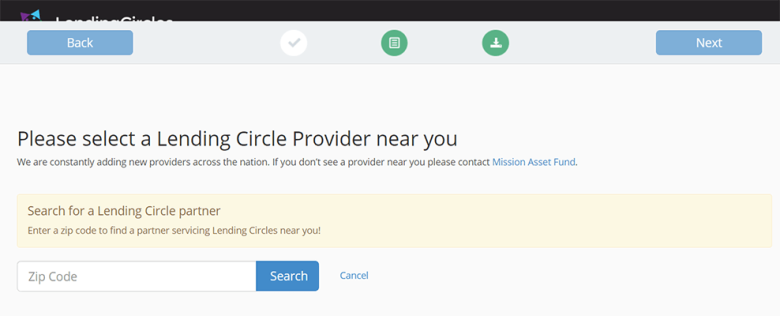

- Lending circles. An organization or community that gives a loan to small businesses. To get the fund, you may need to join its financial education course. One site to find a lending circle is Mission Asset Fund’s Lending Circles.

- Business plan competitions. You’ll have to pitch your business plans in front of judges that will give you helpful feedback. And if you win, you’ll get money to start your business.

6. Look into the Business Loan Options

It may not be easy to qualify for a traditional business loan, especially if you’re a student or a recent graduate that just started a business.

However, you may get it with specific requirements, such as:

- A credit score of 670 or higher

- Strong financial statements

- Positive cash flow

- Hefty assets

If you’re qualified, there are some loan options to consider.

The first option is micro, small, and medium enterprises (MSME) loans or the like. Generally, it offers the lowest rates among other options. However, it may require lots of documents, like business registration proof and bank statements.

An alternative is to apply for a personal loan for business purposes. It can be more suitable for a brand new business as the process is faster. However, the amount you can borrow will be lower than MSME loans.

7. Consider Working with a Mentor

Starting a business all by yourself can be intimidating. Therefore, consider seeking a mentor to give you ideas, such as helping to create a business plan or explaining how to market your business.

If you live in the United States, the Small Business Administration (SBA) has a local assistance tool providing training and counseling for small businesses. Or, you can visit SCORE, a non-profit organization that connects new-level entrepreneurs with volunteer business experts.

If not, try to look for this kind of assistance in your local area.

An alternative is to check your alumni network and see if there’s an alumnus interested in sharing their expertise. To do this, go to your alumni service department or search on LinkedIn.

8. Never Miss Your Student Loan Payment

There are many reasons to miss the student payment, such as financial strain or prioritizing the money for the business. However, delaying student loans can result in much higher interest and lower credit score, which is not good if you want to apply for business loans in the future.

To avoid missing the student loan payments, keep track of the due dates or set up autopay. Also, make sure your contact information is up-to-date so that you won’t miss updates from the lender.

Conclusion

Planning to pay off student loans when starting a business can be scary. However, there are some practical tips for making it less stressful.

First, review your student loans, including the interest rates and repayment options. Then, consider seeking discounts and a more suitable repayment option to help you balance your cash flow. Debt settlement comprehensive guide is also one of the things you need to reconsider when managing your repayment options. Also, don’t miss the loan payment as it can increase the interest rate.

Then, choose a low-risk business idea and search for the best funding option. It can be self-funding, crowdfunding, or a business loan. Finally, consider getting a mentor to help you start it off.

Good luck.