It is practically impossible to be unaware of what a credit card is and how it works. The most effortless approach to understanding credit cards is to think of it as a short-term loan with a set limit to make purchases and pay bills. As a result, it proves to be an excellent companion for international travel where carrying hefty cash is not a good idea.

Like many others, is buying a reliable credit card on your to-do list? If yes, that is great! However, choosing a credit card is not an easy task. Each card varies in terms of credit limits and interest rates, which play a significant role and can haunt your financial plan if not paid attention to. You surely would not like paying more interest on the card itself than you use for your shopping spree, right? But what if you can access authentic credit cards at a well-positioned rate with generous perks and bonuses, like free airport lounge access? Regardless of how dreamy you may find it, some cards offer free visits to airport lounges, some globally and others domestically.

As international travels becomes more popular, credit cards with free airport lounge access have become an excellent choice. So buckle up and read ahead to learn about the top credit cards that offer free airport lounge access and their features and benefits!

7 Credit Card that offers free airport lounge access

Finding “the one” credit card that suits you the best can be challenging. With so many issuers devising their cards with limitless benefits and features, it is a dilemma to tackle this challenge fairly. Here is a curated list of credit cards that offer free lounge access:

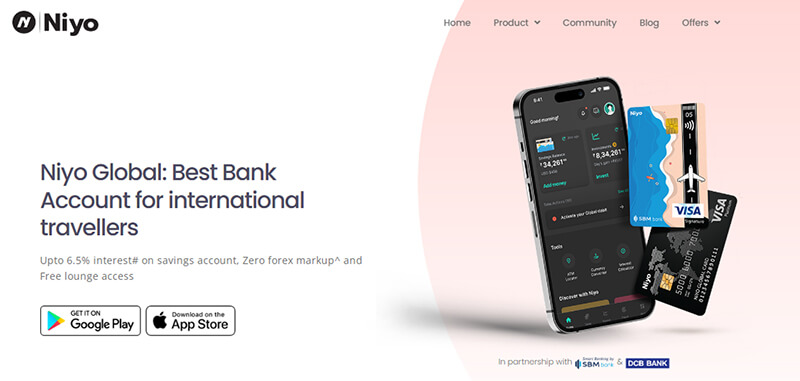

1. Niyo Global Card

Niyo Global is a comprehensive, one-stop payment solution. The card comes with several different features and exciting benefits across multiple categories.

Features

Niyo Global Card is packed with several perks and features. For instance,

- Zero Forex Markup Card with VISA exchange rate

- Add money in INR via IMPS, NEFT, or UPI

- Add money in INR via IMPS, NEFT, or UPI

- Complimentary airport lounge access across India

- Integrated Niyo Global app to manage card and accounts

- Real-time in-app Currency converter

- In-app nearby ATM locator

Joining Fee

The card has zero joining fee.

Rewards and Benefits

This card comes with a bundle of rewards, such as:

- Insurance of up to 5 Lakhs

Besides rewards, the Niyo Global card comes with the following benefits:

- 5 % interest on the savings account with a monthly payout.

Airport Lounge Access

Niyo Global Card comes with complimentary airport lounge access.

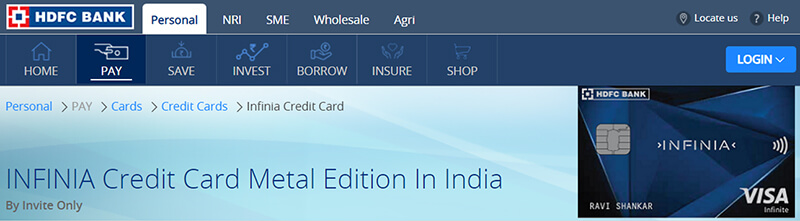

2. Infinia Credit Card

Infinia is one of the best credit cards for free airport lounge access and denotes unbounded possibilities in every aspect. It is equipped with a list of unbelievable features and benefits. Although the joining fee is higher than some, the benefits and rewards make it worth the experience.

Features

HDFC Infinia credit card inhibit tons of features, like

- A 50-day interest-free period

- Low markup fee of 2% on international transactions

- Spending of Rs. 150 accumulates 5 points

- Card limit of Rs. 10 lakhs

- 1% of the convenience fee is waived off on fuel transactions

- The nominee receives insurance compensation worth Rs. 3 crores if the cardholder meets an unfortunate accident

Joining Fee

You can subscribe to the card for Rs. 10,000 per year, including all the charges and taxes.

Rewards and Benefits

Some of the incredible rewards customers get using Infinia are:

- 5 points on every Rs. 150 spent

- 10 points on travel and shopping via Smartbuy

- Gold membership on club Vistara

The card holds various lifetime and other benefits for the cardholders:

- Access to exclusive restaurants at golf courses

- Club Marriott membership with 20% discount

- 15% off on 3000 participating restaurants

- 100% green fee waiver during the international trip

Lounge Access

HDFC Infinia provides unlimited Priority Pass Membership and MasterCard Lounge Access Program that offers free airport lounge access to over 700 airport lounges worldwide, with four lounge visits quarterly.

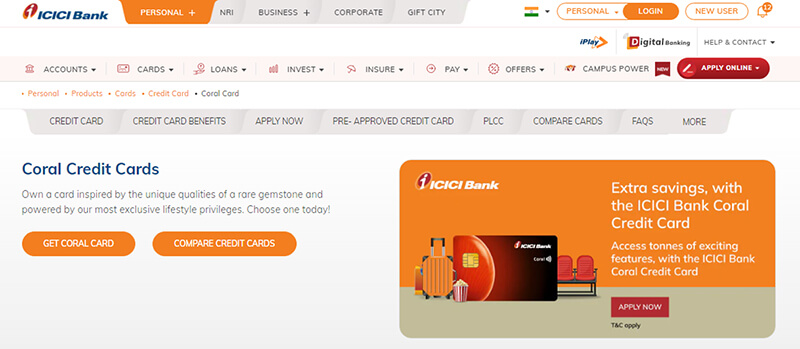

3. Coral Credit Card

ICICI offers one of the best credit cards in three variants: AmEx, Visa, and MasterCard. The card is loaded with rewards and benefits ranging from dining to movies. You can get the card for only Rs. 500 and partake in the never-ending list of perks it offers.

Features

ICICI Bank Coral credit card provides exceptional features to cardholders:

- 4% of interest rate per month

- Zero-liability protection

- Redeemable reward points on various categories and cash back

- The card offers a 1% surcharge fee waiver in HPCL fuel stations across India

- Complimentary access to the airport and railway lounges every quarter

- Foreign currency markup of 3.5% against the transaction amount

Joining Fee

ICICI Bank Coral credit card requires a joining fee of Rs. 500 in addition to applicable charges.

Rewards and Benefits

You can avail of stipulating rewards by purchasing the coral credit card:

- You can earn 10,000 reward points annually

- Spending Rs. 100 with a card provides two reward points

- 1-reward point is equal to Rs. 0.25

Some of the notable benefits you can acquire with this card are:

- Discount of 15% or more on dining bills at 2500+ restaurants

- 25% off on buying two movie tickets on INOX and BookMyShow

- Access to railway lounges in India

- 2000 reward points for spending Rs. 2 lakhs within the anniversary year

Airport Lounge Access

ICICI Bank Coral credit card promises one free airport lounge access in domestic airports per quarter.

4. Cashback SBI Card

The newly launched cashback credit card has become one of the trendiest in a short time. SBI provides cashback for every transaction you make using your new card. The compelling feature, however, is that you can avail of it without paying any joining fee.

Features

Some of the nifty features of the Cashback SBI card are:

- Forex currency markup of 3.5% of the international transaction

- 5% interest per month

- No add-on card fee

- 1% of fuel surcharge waiver from Rs 500 to Rs. 3000 transactions in fuel stations within India

- Promises zero liability protection to the cardholder

- Utility bills and offline transactions via Cashback SBI card guarantee 1% cashback

Joining Fee

Banks and financial institutions issue cards with zero joining fees. However, annual charges of Rs. 999 are applicable to the card.

Rewards and Benefits

Although the card requires zero joining fee, it comes with multiple reward perks:

- Free 2 add-ons for family members for a lifetime

- Option for contactless payment in transactions less than Rs. 5000

- 5% cashback on online transactions

Cashback SBI card provide considerable benefits to primary cardholders:

- Fee waiver on Rs. 2 lakhs expense annually

- The earned cashback is auto-credited within 2-days of the following statement

- You can claim a maximum waiver of Rs. 100 monthly

Lounge Access

Cashback SBI Card facilitates four quarterly free airport lounge access in airports within India.

5. Millenia Credit Card

Millennium credit cards are a preferred choice of Gen-Y- (90s) kids and millennials. HDFC offers its exceptional card in four variants: Visa, Diners Club, RuPay, and MasterCard. Further, the card is available at a fee of Rs. 1000, excluding taxes, and facilitates several features and benefits. The card offer free airport lounge access and many other surprising benefits.

Features

HDFC Millennium credit card provides multiple features. Some of them are:

- Guaranteed Zero-Liability Protection

- You have to pay a 3.6% monthly interest rate

- No add-on card fee

- 1% of fuel surcharge on spending Rs. 400 at any gas station in India

- 5% Forex currency markup on international transactions

- 1 CashPoint is equivalent to Rs. 0.30

Joining Fee

The card comes with a joining or annual fee of Rs. 1000 with applicable taxes.

Rewards and Benefits

The Millennium card lays out multiple striking reward benefits for cardholders:

- You receive 1000 bonus CashPoints as a welcome gift once you pay the joining fee successfully

- Renewal fee waiver if you spent Rs. 1 lakh in the previous year

- Offers 5% cash back as CashPoints at select partner online merchants

In addition to the various reward perks, the HDFC Millennium credit card puts several benefits on the table:

- 20% discount on partner restaurants

- Complimentary Dineout Passport Membership

- 1% cash back on other payments

- good food trial program at premium restaurants with a 25% of assured discount

Free Airport Lounge Access

HDFC Millenia credit card offers eight free airport lounge access to domestic airport lounges all over India. You can avail of a maximum of two visits per quarter via a Millennium card.

6. Exclusive Credit Card

Dive into the world of exclusive privileges with YES First Exclusive credit card. YES First offers an unbeatable blend of stunning rewards, lifestyle benefits like shopping reward points and free airport lounge access. Using this secure and reliable card, you can get your hands on the key to a world of coveted premium services.

Features

Some of the features of one of the best credit cards for international lounge access are:

- An impressive foreign currency markup of 1.75%

- Accompanies Zero liability protection

- An interest rate of 2.99% per month

- Insurance coverage with coverage on medical emergencies when traveling abroad

- A 1-reward point equals Rs. 0.25

- Complimentary golf course lessons

Joining Fee

YES First exclusive credit card is available with a joining fee and annual fee of Rs. 10,000, excluding GST.

Rewards and Benefits

YES First exclusive credit card delivers the following rewards to cardholders:

- 50,000 points as a welcome reward

- 10-reward points on the spending of Rs. 100

- 25,000 reward points on an annual expense of Rs. 20 lakhs

Further, it comes with additional benefits:

- Provides overwhelming concierge services with flowers and gift delivery

- Movie ticket assistance in Chennai, Bengaluru, and New Delhi

- credit shield covers the accidental death of the cardholder

Free Airport Lounge Access

- Unlimited free airport lounge access in 1200+ airports worldwide at absolutely zero cost with a Priority Pass

- Unlimited free airport lounge access in 30 airports with MasterCard in India.

7. My Zone Credit Card

Axis Bank offers a fundamental yet trendy credit card, My Zone, to its customers and non-customers. The card accompanies several eye-catching features and exciting benefits across multiple categories. And the point that you can have your very own My Zone credit card with a nominal joining fee is the icing on the cake.

Features

Axis Bank My Zone is packed with several perks and features. For instance,

- Provides zero liability protection

- A monthly interest rate of 3.4%

- No add-on card fees or charges

- Foreign currency markup equal to 3.5% of the transaction amount

- Edge points, where 1 point is equivalent to Rs. 0.20, are redeemable for purchasing items or travel vouchers

- The credit limit varies depending on your credit history, income, debts, and other credit card limits

Joining Fee

The card is accessible with a pocket-friendly fee of Rs. 500 annually, with additional applicable taxes.

Rewards and Benefits

This full-fledged credit card exposes you to unlimited subscription rewards and more.

- Complimentary SonyLiv Premium annual subscription for Rs. 999 as a welcome reward to customers

- About 20% off at partner restaurants with Dining Delights

- bank presents you 4 EDGE points for every spending over Rs. 200 you make with the card

Besides rewards, My Zone puts various benefits on the table:

- “Buy One, Get One” offer on movie tickets when booking with Paytm Movies

- 600 off on minimum spends amounting to Rs. 2000 on the well-known online shopping platform, AJIO

- 25% cash back on the purchased movie tickets

- Discount of 40% on Swiggy up to Rs. 120 for every order

Airport Lounge Access

My Zone credit card users can relish four complimentary visits per year in the lounges across any airport within India. You can avail of free airport lounge access every quarter in domestic airports.

Conclusion

A credit card can be crucial for your financial life or detrimental. That is why it is essential to go through multiple options and curate them based on suitability. Nowadays, international debit cards also come with similar attributes and promise seamless and smooth international travel. Travel cards with free airport lounge access and zero markup fees have become a prime choice for many. At last, it is preferable to decide based on your needs, requirements, and budget.