Introduction

One of the most difficult parts of developing real estate projects, especially in the beginning, is securing the funding you need to bring your project to completion. Generally speaking, the costs of developing these projects outweigh what an individual practitioner or new company can muster. This is why it’s important to look into innovative and alternative strategies for securing funding, particularly if you have a relatively new portfolio or haven’t established one yet.

We’ll be going over some of the most effective ways for you to generate funding and build that portfolio.

Strategies for Securing Funding for Your Real Estate Projects

Securing funding is a critical aspect of success in any industry. Whether you’re a seasoned developer or just starting out, having innovative strategies can make all the difference. In this article, we’ll explore five approaches to help fund your real estate ventures.

From forming equity partnerships to considering alternative financing options, these strategies offer new avenues to secure the funding you need for your projects:

1. Offering Equity Partnerships

Equity partnerships are incredibly common in the real estate market, as they provide an incredibly useful and convenient mechanism for practitioners to access funding. This involves working directly with investors who share the same vision for the project and offering them equity in your business in return for their funds.

You will get access to the funding you need, but you’ll also be able to benefit from spreading the risk between you and new stakeholders whilst also benefiting from the wealth of experience and potential contact list of the individual you wish to enter an equity partnership with. This approach is particularly useful if you’re working on large-scale projects that require significant funding to be completed.

2. Use Real Estate Fundraising Software

One of the best ways to raise funding for your projects is through the use of real estate fundraising software. These tools are intended to make it easier for you to identify potential investors who can back your project whilst also making it easier for you to onboard them and identify key data trends related to your investors.

Overall, this helps you streamline your processes and get faster access to funds. Here are some of the main ways a real estate fundraising software can help:

1. The ability to generate brochures on advertised projects and easily send them to targeted investor lists or in your own marketplace.

2. Effectively manage inbound prospects and their current deal status, with automatic notifications of required actions and changes to the deal stage.

3. Create custom workflows based on various investor characteristics and speed up the deal process using legally binding e-signatures.

3. Identify Potential Private Investors

One way to try to secure funding is to identify potential private investors, particularly high-net-worth individuals, who can help finance your project. There are organizations that enable you to purchase lists of high-net-worth individuals within a specific area, so a good strategy would be to procure such a list and then use it for outreach to these investors.

You can explain the project and its benefits to the potential investors and gauge their interest in funding your project. Also, sometimes, it is easier to deal with individuals as opposed to institutional investors.

4. Explore the Potential of Crowdfunding

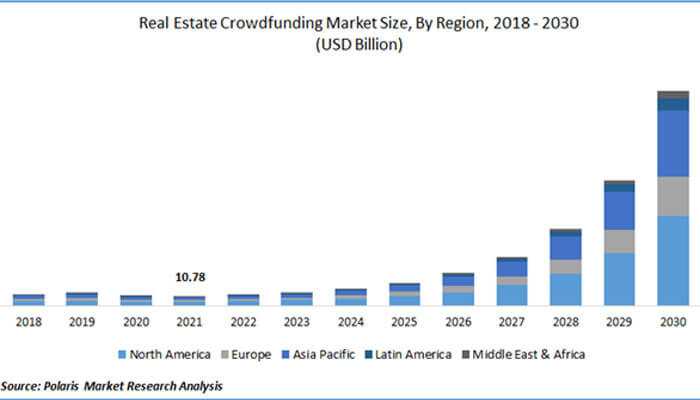

One of the most recent developments in real estate investment is the increased use of crowdfunding. The size of the crowdfunding real estate market is expected to grow to $2724 Billion in 2036. There are already numerous active websites where practitioners can list a project or development.

These platforms have an active community of crowdfunding investors who can view the project and its potential and pay a smaller percentage of the project costs in return for smaller distributions.

This method is particularly useful if you have time to collect the funds and develop the project and don’t have any high-net-worth or institutional contacts that you can pitch the project to.

5. Explore Alternative Securing Funding Options

If you’re struggling to gain external investment, then other institutional financing arrangements could be beneficial to getting the securing funding your project needs. One example of this is mezzanine financing, also known as bridge loans. These loans can come with higher interest rates.

However, they’re a useful and ever-growing tool for developers who simply need an injection of cash to get their project to completion. They are particularly useful in circumstances where traditional financing methods aren’t sufficient to meet your needs. They are in between debt financing and equity financing, with some features of each. You should explore this option with a financial advisor.

Conclusion

Even if you’re not capable of individually financing your projects, there are a lot of different methods you can use to make up the shortfall and begin building your portfolio. All of these methods are routinely used by real estate practitioners with large degrees of success and can be incredibly useful depending on the circumstances of your project.

You should do extensive research into each method, as the intricacies of each fundraising method can be complicated, and acquiring thorough knowledge is essential to making an informed decision.