ETFs are Exchange-traded funds. They are the best building blocks for investors and are appropriate for beginner investors. Using ETFs, the best in the market, and building a rounded portfolio takes a few minutes.

10 Best ETFs Trading Strategies for Beginners

1. Systematic Investment Plan (SIP)

SIP is one of the ETFs trading strategies requiring investing money in a fixed amount each month in your choice of ETF. It is mostly for a lengthy period to see the benefit, and it brings the cost of your investment. The SIP route allows for the purchase of more units with a low ETF price and vice-versa. The strategy of ETF is a powerful phenomenon earning higher gains.

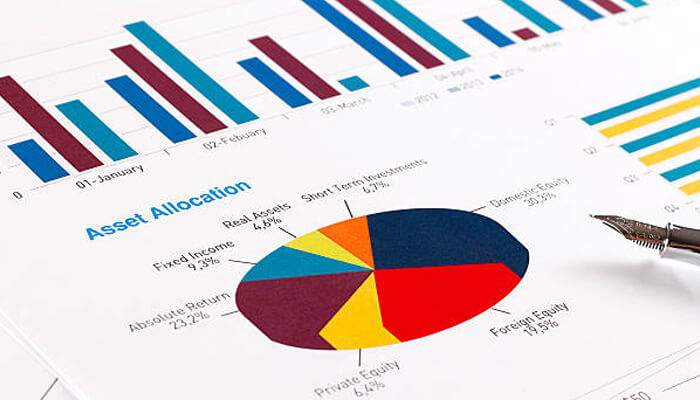

2. Asset Allocation

It is to allocate a portfolio portion to asset categories such as bonds, stocks, cash, and commodities. It is a powerful diversification investing tool. Asset allocation is a trading ETF strategy relying on risk tolerance and investment time horizons. You may embark on major changes, such as buying a house or starting a family. It means to shift to investments that are less aggressive, with 60% and 40% in ETFs, equities, and bonds.

3. Swing trading

Swing trading captures price movements of short-term in an ETF. This strategy lasts for a few days or weeks. Here one enjoys the freedom combination of ETF units buying and selling. Swing trading has a bullish view, and per unit price goes up such that you can earn a small profit and walk away.

4. Dollar-Cost Averaging

Dollar-cost averaging is to buy an asset on a fixed-dollar amount on a schedule, whatever the asset cost. Investors beginning are mostly people with stable incomes, and they can buy it as they save every month to buy this asset. These are the investors who do not bother about the market returns. They invest in ETFs as a group or individually. They enjoy discipline savings and the same amount of savings in ETF.

5. Sector rotation

Sector rotation involves picking sectors in demand. This trading ETF strategy is easy to execute and is the right option for beginners. Using a sector rotation strategy investing in a particular sector ETFs assures favorable profits. ETFs are for seasonal trends. With the season blowing cash out and investing in the next trending seasonal industry, working like a swot analysis.

6. Passive Strategy

ETFs place a diversified portfolio of stocks, and they mirror without active management of the world market. Pick ETFs featuring asset allocation basic categories. The emerging and international markets, medium, small, and large-cap markets, growth, and bonds are a few additions.

7. Hedging

Investors and traders hedge investment risk using ETFs. It acts as a hedging risk instrument. Using an ETF, such as nifty, safeguards from downside risk. It protects your position as an index option and has no losses. Investing and protecting the investment, ensuring no downside risk means executing the reverse strategy.

8. Seasonal trends betting

Make money on seasonal trends. A seasonal trend in September and October is the gold gain as it is the wedding season. A beginner can benefit from the gold strength by using units and making investments. Predicting seasonal trends is difficult, there may be changes affecting market returns.

9. Short-selling

Short-selling is to sell for a higher price and purchase the same at a lower price. The profit is the difference between selling and buying. Short-selling is a riskier trading strategy of ETFs, and its execution must be done with caution. The market returns may differ. If it is favorable, do as expected and enjoy the trade profit.

10. SWOT Analysis

Swot analysis helps in understanding the competitive advantage and deciding with leading businesses. Knowing the fundamental analysis reveals the major and minor problems in a company. It harms the stock price in the future. A SWOT analysis identifies threats and big opportunities impacting stock returns.